Welcome to the Greythorn Market Update for February 2024. As cryptocurrencies continue to play a pivotal role in the financial landscape, we understand the importance of keeping our readers up-to-date with the most recent trends and advancements in the realms of digital assets and blockchain technology.

One of our key commitments at Greythorn is to provide our readers with monthly insights into the cryptocurrency markets, encompassing detailed analysis of market trends, updates on regulations, and the macroeconomic factors influencing these digital currencies.

For more information about us, please visit our website.

Bitcoin Analysis

February’s Market Dynamics

February witnessed a complex interplay of economic signals, regulatory actions, and market sentiments that shaped the Bitcoin landscape. The month began with Jerome Powell making a notable change in his tone during the post-FOMC press conference statements compared to previous meetings, dropping the reassurance about the resilience of the U.S. banking system, a move that has rippled through the financial markets with varying effects on different asset classes, including Bitcoin.

Jerome Powell’s comments implied that a reduction in interest rates in March was improbable, leading to a decline in both stock and bond markets. Bitcoin’s value dropped from $43,600 to approximately $41,800, in contrast to past scenarios such as the banking crisis in March 2023, during which Bitcoin’s price had risen, positioning it as a perceived safe haven amidst the instability of the traditional banking sector.

This highlights the nature of Bitcoin’s market behaviour. It can align with the broader financial markets, functioning as a risk asset, while in other instances, it acts as a haven during times of economic uncertainty.

Despite the initial drop, BTC quickly rebounded, demonstrating the robust demand for BTC nowadays. The recovery was notably buoyed by sustained interest from both institutional and retail investors.

Environmental Concerns and Bitcoin Mining

The U.S. Energy Information Administration (EIA) announced that Bitcoin miners within the United States must fill out a survey detailing their energy consumption. A report was also released indicating that Bitcoin mining accounts for approximately 0.6% to 2.3% of the nation’s total electricity usage. This revelation sparked widespread discussion concerning the environmental impact of Bitcoin mining. However, it’s noteworthy that the report overlooked two crucial aspects: firstly, over half of Bitcoin mining operations utilise green, renewable sources of energy. Secondly, the role of Bitcoin mining in enhancing the stability of the electricity grid and reducing pollution remains underappreciated.

Regulatory Developments and Legislative Pushback

Additionally, the legislative push against regulatory overreach, such as the bill presented by Representatives Wiley Nickel and Mike Flood together with Senator Cynthia Lummis to prevent federal agencies from imposing excessive capital requirements on crypto assets in custody, reflects a growing acknowledgment of the importance of clear and fair regulations for fostering innovation and investment in the crypto space.

This legislative move challenges the SEC’s SAB121 guideline from 2022, which mandates banks to list the value of crypto assets held in custody as liabilities on their balance sheets, necessitating a corresponding capital provision. Critics argue that this requirement is flawed because these assets do not belong to the custodian and should not be recorded as liabilities. The bill, if passed, could significantly impact the crypto industry by enabling regulated banks to custody crypto assets, potentially boosting institutional investment in the sector.

Price Movements, Investor Sentiment, Liquidity and Institutional Interest in Crypto

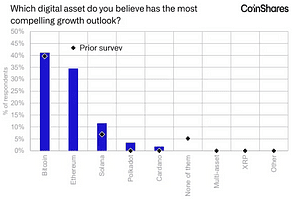

Among these discussions, sentiment towards Bitcoin during February remained strong, as evidenced by the results of CoinShares’ quarterly fund manager survey, which also indicates a continued preference for Bitcoin over other cryptocurrencies. Despite regulatory and volatility concerns, the crypto asset class is gaining traction among institutional investors, with Bitcoin leading the preference chart.

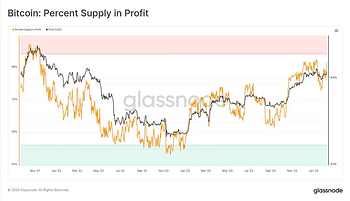

The liquidity improvement in the Ethereum market, despite not directly benefiting from ETF-related flows (more about this soon), and the notable inflows into BTC spot ETFs suggest a growing institutional interest and confidence in the crypto market. This is further supported by the resilience of BTC holders, with 90% of BTC currently held in addresses that have not moved their BTC despite potential profit-taking opportunities. This indicates a strong conviction to hold.

As February progressed, the price of Bitcoin experienced significant movements, breaking the $50,000 mark on the 14th, a testament to the growing buying pressure and easing selling pressure. The release of January’s CPI data, which highlighted ongoing inflation challenges, initially caused a sharp drop in BTC prices. However, Bitcoin quickly diverged from traditional risk assets, recovering and even reaching new year-to-date highs, showcasing again its potential as both a risk asset and a hedge against economic uncertainties.

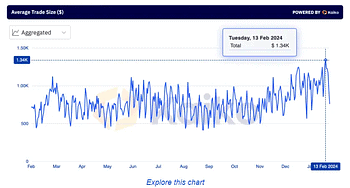

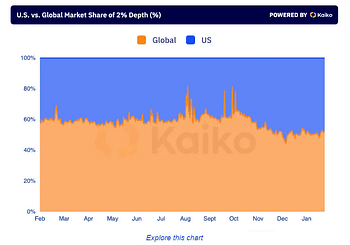

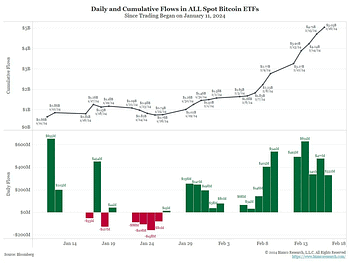

Throughout the remainder of the month, there have been indications that the introduction of BTC spot ETFs has positively affected market liquidity. This is evidenced by an increase in BTC spot trading volumes and a noticeable rise in the US’s contribution to market depth. Such trends suggest that BTC spot ETFs are significantly influencing the market, coupled with growing institutional interest, as indicated by larger average BTC trade sizes.

Discussion on Ethereum market liquidity

As February drew to a close, Ethereum also began to capture considerable attention. As the second-largest cryptocurrency by market capitalization, Ethereum has been the subject of much speculation due to its recent underperformance compared to Bitcoin. However this trend has recently started to shift, and several factors hint at a potential breakthrough for Ethereum: It has been lagging behind Bitcoin in performance over the past few months, there’s anticipation of a possible spot ETF approval later in the year, and Ethereum is set to undergo a significant upgrade on March 13, which could impact its market position.

Bitcoin’s End-of-February Breakout

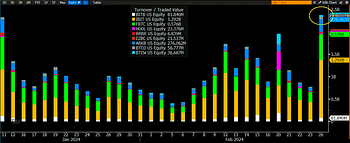

After a period of little movement, even as Ethereum saw gains, Bitcoin started to make a big move by the end of February, crossing the $60,000 mark. The momentum behind this movement is largely attributed to a surge in ETF investments and strong participation from Asian investors. For instance, BlackRock’s IBIT saw trading volumes nearing $1.3 billion in just one day. While this doesn’t exactly translate to net inflows, a significant portion likely represented new investments.

Yet, this cycle stands out because of factors like ETF investments, which are expected to bolster the market’s foundation. Any dip in prices might be seen as an opportunity by both big and small investors, comforting them with the thought that they haven’t missed out on the upward potential yet.

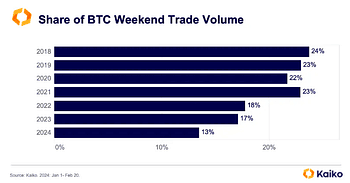

It’s also important to remember that, even taking into account BTC’s price surge, the weekend trading volume of BTC, as a share of its total trading volume, is still about half of its level from six years.

On-Chain Analysis

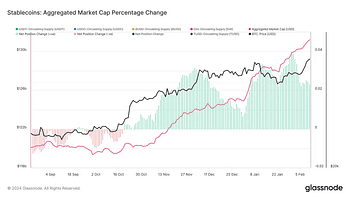

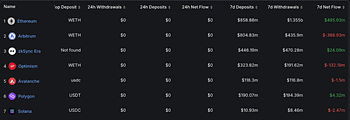

The stablecoin sector experienced a swift surge in supplies during February. This development goes beyond the usual market fluctuations, signalling a renewed trust in the cryptocurrency space, evidenced by a considerable flow of fresh investments into the market.

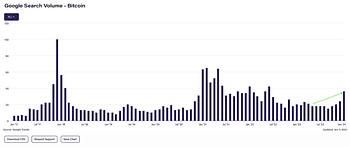

With Bitcoin approaching its historical peak, there’s a clear increase in public curiosity. Data from Google Search Trends indicates that the number of searches for “Bitcoin” has hit its highest point since June 2022.

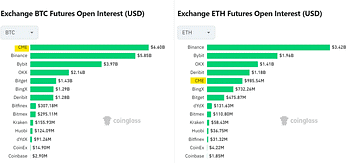

When comparing the open interest in BTC futures on the CME with other exchanges, dominance by the CME signals strong interest from US-based institutions. Currently, the CME leads in BTC futures open interest, surpassing even Binance, indicating a heightened institutional engagement. However, this trend does not extend to ETH, where the CME ranks fifth.

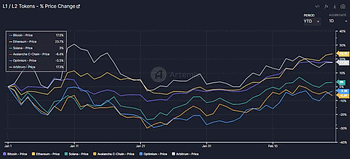

Despite a slow beginning to 2023, Ethereum has quietly made a remarkable comeback, outperforming Bitcoin, Solana, Avalanche, and leading Layer 2 technologies such as Arbitrum and Optimism by a considerable margin year-to-date.

Investments into all spot BTC ETFs have surged, setting unprecedented records for the ETF industry in the initial weeks.

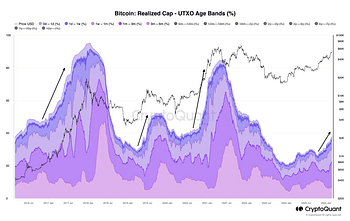

Considering the fresh funds flowing into Bitcoin, it seems we’re just beginning a new phase. Currently, short-term investors’ contributions make up 35% of the total realised value.

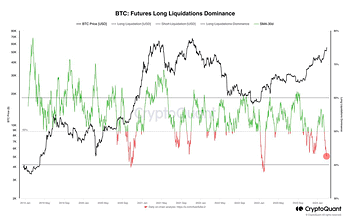

Despite the current upward momentum, short-sellers continue to bet against it, experiencing liquidations as a result of their opposing bets. It appears that bears are not paying much attention to the on-chain metrics.

Particularly in the past week, the funds that were initially directed towards Sui and Solana at the start of the month appear to be shifting back to Ethereum.

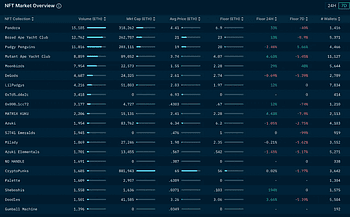

Pandora NFTs are bouncing back, suggesting that ERC404s may be here to stay. Meanwhile, Pudgy Penguins are holding strong with a floor price of 20 ETH. However, notable absences in prominent collections include Sappy Seals and Kanpai Pandas, which have also seen significant increases in value, with Seals surpassing a 1.7 ETH floor and Pandas exceeding a 2.5 ETH floor.

Disclaimer: The crypto landscape is vast and ever-changing, with numerous metrics of interest daily. This overview highlights select monthly metrics for brief insight and is not comprehensive.

Highlights

- MicroStrategy’s Bitcoin Portfolio Reaches $12.24 Billion as Bitcoin Breaks Past $60,000

- SEC Accuses HyperFund Founders of $1.7 Billion Fraud

- Tether Achieves $2.9 Billion Q4 Profit and Bolsters Reserves to $5.4 Billion

- FTX to Fully Repay Customers Despite Halting Restart Plans

- Celsius Network Initiates $3 Billion Payout Post-Bankruptcy with New Mining Venture

- Ethereum Hits Milestone with 25% of ETH Supply Staked

- Bitcoin Mining Difficulty Surges Past 80 Trillion, Setting New Record

- Spot Bitcoin ETFs Achieve Over $50 Billion in Cumulative Trading Volume

- Ethereum’s Dencun Upgrade Successful on Sepolia Testnet, Eyes Mainnet Launch

- Harvest Fund Eyes First Hong Kong Spot Bitcoin ETF

- Bitcoin Mining Firm GRIID Debuts on Nasdaq

- Uncorrelated Ventures Launches $315M Fund for Crypto and Software Startups

- Vitalik Buterin Eyes Crypto-AI Synergies, Backs New Generation Leadership

- Polygon Labs Reduces Workforce by 19% Amidst Organisational Refocus

- XRP Suffers Price Dip Amid $113 Million Exploit of Ripple Co-founder’s Accounts

- EigenLayer TVL surpases $6 Billion as Deposit Caps Lift

- Kraken Expands European Presence with Dutch Licence

- Binance to Delist Monero, XMR Price Drops 15%

- Solana Network Resumed After Five-Hour Outage

- Frax Finance Launches Layer 2 Network Fraxtal

- Ethereum NFT Volume Nears Yearly High

- Thailand Exempts Crypto Gains from Value-Added Tax

- OKX Expands to Argentina with Exchange and Wallet Services

- Coinbase Surpasses Q4 Expectations with Soaring Transaction Revenue

- PlayDapp Suffers $290 Million Token Loss in Dual Exploits, According to Elliptic

- Pudgy Penguins Outshine Bored Ape Yacht Club in Historic Floor Price Flip

- Starknet Token Unlocks Stir Controversy Among Investors and Community

- Court Approves Genesis’s $1.3 Billion GBTC Share Sale

- Ripple Expands Regulatory Capabilities with Standard Custody Acquisition

- FTX Granted Approval to Sell $1 Billion Stake in AI Firm Anthropic

- Circle Ends USDC Support on TRON Network for Enhanced Risk Management

- AI Cryptocurrencies Surge Following OpenAI’s Launch of Sora Text-to-Video Generator

- Trump Softens Stance on Bitcoin, Suggests Openness Amid Election Campaign.

- Gemini Settles Lawsuit with New York Regulator, Agrees to Return $1.1 Billion to Customers.

Macro Analysis

Market Turbulence and Regulatory Responses in China

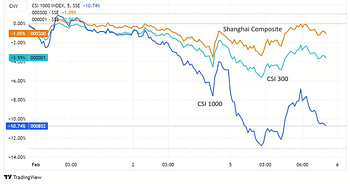

February began with a significant downturn in the Chinese stock markets. The CSI 1000 index saw a dramatic decrease, dropping nearly 9% at one point during the trading session, with 99% of its companies experiencing losses. The more selective CSI 300 index also suffered, falling by 2%.

In response to the rapid decline, the China Securities Regulatory Commission (CSRC) quickly acted to stabilise the market, issuing a commitment to combat “abnormal fluctuations” in stock prices and to infuse the market with more medium- and long-term funds. This intervention prompted a notable recovery; the CSI 1000 index rebounded impressively, posting almost a 7% gain. This rebound helped the CSI 300 index to close with slight gains and allowed the CSI 1000 to reduce its losses, although it still closed down by 6%, marking a nearly 30% loss year-to-date.

Further, the CSRC took additional steps to stabilise the market, implementing stricter rules against short selling, prohibiting some quantitative hedge funds from placing sell orders, and instructing others to maintain their stock positions.

Authorities also announced the replacement of the head of the securities regulator with Wu Qing, a figure known for his strong stance against financial risk and corruption. With a background that includes running the Shanghai Stock Exchange,

Is also important to remember that China’s ability to deploy monetary stimulus might be limited by the yuan’s vulnerability and inflation risks. Interest rate cuts could exacerbate these issues and negatively affect the profitability of banks. Fiscal stimulus efforts are also constrained by high levels of local debt.

Despite these challenges, there’s growing interest in the potential for Chinese investors to turn to cryptocurrency assets as a hedge against yuan depreciation and broader financial uncertainties. The anticipated introduction of Bitcoin ETFs in Hong Kong could make this shift more accessible.

The US Economic Outlook: Easing Policies vs. Inflation Concerns

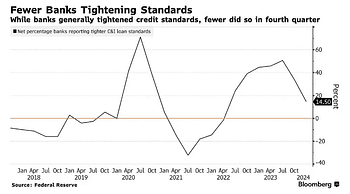

The latest survey from the US Federal Reserve, known as the Senior Loan Officer Opinion Survey (SLOOS), shows that banks are starting to relax a bit when it comes to lending money. This easing up is also seen in the Chicago Fed’s Financial Conditions Index, indicating the easiest financial conditions since November 2021. This shift might signal a change in how the economy is being managed, especially with so much uncertainty around it.

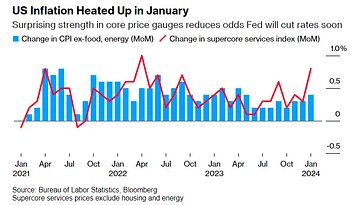

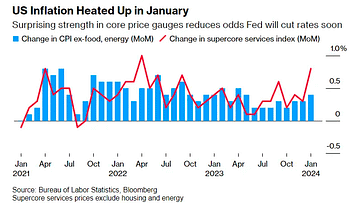

In contrast, inflationary pressures are intensifying, Reports from the Institute for Supply Management (ISM) and the Bureau of Labor Statistics paint a picture of rising costs for businesses and workers alike. The ISM’s latest numbers show business costs going up more than they have since 2012. Also, wages and the cost of labour are climbing, raising red flags about inflation.

Employment figures further illustrate this trend, with a sharp rise in average hourly earnings and unit labour costs, amplifying concerns around inflation.

These mixed signals are leading to second thoughts about cutting interest rates soon. The rise in yields on US 10-year Treasuries shows how the market is reacting to these economic signs, especially with increased worries about inflation in services and the Fed’s focus on persistent inflation trends.

So, we’re in a bit of a tricky spot. On one hand, the economy’s getting a bit more room to breathe with easier lending conditions. But on the other hand, inflation’s rise is a real concern. This balancing act between encouraging growth and keeping inflation in check shows just how complex the economic situation is right now.

Additionally, the Congressional Budget Office (CBO) shared a report with some worrying predictions for the US economy over the next ten years. They said that soon, the government will spend more on interest for its debt than on defence, and by 2034, these interest payments will be bigger than the entire budget deficit for 2023. Also, the ratio of the US’s debt compared to its economy could double compared to what it’s been in past decades. The CBO also expects the cost of borrowing money to go up, which could slow down economic growth and make the debt problem worse.

But, the rising cost of insuring against US debt is making people more interested in cryptocurrencies as an alternative to regular money. This suggests that the value of the dollar might drop when compared to solid investments like gold or bitcoin.

On February 14th, we saw the inflation report for January, and yes, inflation in the US did go up. The markets had a strong reaction with the Nasdaq falling by 1.8%, while both the S&P 500 and the Dow Jones went down by almost 1.4%. The interest rates on bonds, like the 10-year US treasury, shot up by 15 basis points quickly. Initially, Bitcoin also fell along with stocks and bonds, but it quickly recovered.

Global Economic Overview

- Japan’s economy has entered a technical recession with a decrease in GDP during the fourth quarter, raising concerns for the world’s third-largest economy.

- The UK has also faced a recession, with a more significant contraction in the fourth quarter than expected, indicating widespread economic difficulties among major economies.

- The European Union’s GDP growth was almost flat in the fourth quarter, barely avoiding a contraction. With growth forecasts for 2024 being revised downwards, the EU is nearly facing a recession, worsened by Germany’s poor economic outlook.

- The European Central Bank is managing expectations around interest rate cuts, emphasising the need for more data before considering easing. This cautious stance contrasts with the Eurozone’s economic challenges, such as inflation and the need for rate adjustments, demonstrating the tricky balance central banks navigate during uncertain economic times.

- Nigeria has taken steps to prevent the devaluation of its currency, the naira, by restricting access to cryptocurrency exchanges. This measure aims to reduce capital flight and speculative trading.

Closing Remarks

February has marked a significant period of success for Bitcoin and the wider cryptocurrency market, even amidst some uncertainties within the larger economic context. The crypto industry appears to be entering an exciting phase of expansion, with numerous compelling narratives emerging that are poised to secure a strong foothold for growth in the coming months. To stay informed about these developments, consider following us on LinkedIn, where we share in-depth research and analysis, as well as on Medium and our X account, for comprehensive insights into the evolving crypto landscape.

DISCLAIMER

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser. This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.