Since the Shanghai upgrade, the Ethereum staking market has gradually become more popular. Currently, the staking ratio for ETH has reached 24%. According to Nansen’s data, the entire ETH staking market has consistently shown an upward trend, with the current staked ETH reaching a high of 29.2 million (currently valued at $65.67 billion). According to Defillama’s data, the total TVL (Total Value Locked) in the liquid staking market has also reached $31.43 billion, ranking first in the DeFi space.

Source: Nansen (https://pro.nansen.ai/eth2-deposit-contract)

The LSDFi narrative has emerged in response to the popularity of LSD. The underlying logic of LSDFi involves maximizing benefits for LSD holders by providing additional returns. According to data from Dune Analytics, the current TVL of LSDFi is only $1.63 billion. Compared to the current TVL of liquid staking, there is significant growth potential for the LSDFi narrative.

In 2024, the TVL in LSDfi protocols surged to $1.8 billion, with liquid staking representing about 40% of all Ethereum staking.

Next, Greythorn Asset Management will bring you three specific projects. Let’s take a look at them together.

Prisma Finance ($PRISMA)

Project Name: Prisma Finance

Project Type: LSDFi

Ticker: PRISMA

Cryptocurrency Rank #: 1005

TVL: $414.39m

Market Cap: $16.48m

Fully Diluted Valuation: $326.85m

Prisma Finance is a DeFi platform dedicated to unlocking the full potential of Ethereum’s liquidity staking derivatives. Through Prisma, users can mint stablecoins(mkUSD) that are fully collateralized with LST, using wstETH, rETH, cbETH, and sfrxETH.

Benefits of using Prisma Finance:

- Support multiple types of LSD as collaterals: Currently, Prisma allows users to mint the mkUSD using wstETH, rETH, cbETH, and sfrxETH.

- Multiple yields: In addition to the inherent returns from LSD, users can earn higher yields by minting mkUSD. By depositing stablecoins into the Stability Pool, users can receive up to a 26.36% APR return. Furthermore, users will also receive additional PRISMA emissions as a weekly reward by maintaining an active mkUSD debt.

- Store of Value: Due to its fully collateralized nature, mkUSD is an asset with relatively stable value. At the same time, it can generate a decent additional income for users.

Competitors:

Tokenomics:

PRISMA is the governance token of the Prisma protocol, and has a maximum total supply of 300 million. Users can earn PRISMA by performing the following actions:

- Depositing to the stability Pool

- Minting new mkUSD

- Maintaining an active mkUSD debt

- Staking Curve/Convex LP tokens

PRISMA can be locked to earn protocol fee (Minting / Redemption Fee & Borrow Interest Fee) and boosted yield, and receive lock weight, which can be used to vote for the distribution of PRISMA emissions and vote on protocol ownership actions. The lock up period is up to 52 weeks.

Source: DeFi Llama (https://defillama.com/unlocks/prisma-finance)

Investors:

Bottom Line:

Currently, in terms of TVL, PRISMA is undoubtedly one of the leaders in the LSDFi space. Considering the overall market potential of LSDFi, this project definitely has significant upward potential. However, it’s important to note that there is still a slight risk for users in this project, such as the risk of collateral liquidation and PRISMA token price fluctuations.

Restake Finance ($RSTK)

Project Name: Restake Finance

Project Type: LSDFi

Ticker: RSTK

Cryptocurrency Rank #: N/A

TVL: $4.7m

Market Cap: $36.7m

Fully Diluted Valuation: $192.5m

Project Overview:

Restake Finance, a decentralized finance protocol, revolutionizes the staking landscape with its modular liquid staking solution for EigenLayer. This innovative approach enables users to reap Ethereum and EigenLayer staking rewards without the need to lock up their assets or handle complex infrastructure. Governed by a decentralized autonomous organization (DAO), Restake Finance leverages the RSTK token for both governance and practical utility, primarily focusing on strategies to generate yield.

A key feature of Restake Finance is its ability to facilitate liquid restaking of LSTs (like stETH) within EigenLayer, utilizing its newly introduced restaked ETH token (rstETH). This process is straightforward: users deposit their LSTs into the protocol and, in exchange, receive rstETH. This rstETH represents a tokenized form of restaked Ethereum, essentially functioning as a liquid restaking token (LRT). Holding rstETH guarantees seamlessly earning Ethereum’s staking rewards (estimated to vary between 3%-5%) and also EigenLayer rewards on top (estimated at 10%+).

From the user’s point of view, LSDFi presents a unique opportunity to reinvest yield in a manner that not only enables the continued accumulation of Ethereum’s native interest but also allows for participation in other actively validated systems. This is complemented by the added benefit of earning an additional, risk-adjusted yield through EigenLayer’s capabilities.

Tokenomics:

1) $RSTK → Utility and governance token of the Restake Finance ecosystem.

RSTK’s maximum supply is 100,000,000 tokens.

RSTK is poised to reflect the success of EigenLayer, with its value directly correlated to the yields from EigenLayer. As EigenLayer’s yields increase, along with the expansion of its modules and broader adoption, RSTK holders stand to benefit from greater revenue accrual on the Restake Finance platform.

Regarding the fee structure, Restake Finance has implemented a flat 10% fee on the EigenLayer rewards generated through its platform. This fee is distributed in two parts: half of it, amounting to 5% of the total EigenLayer rewards, goes to the stakers, rewarding their investment and participation. The other half, also 5% of the total rewards, is directed to the platform’s treasury. This allocation is vital for covering operational costs, thereby sustaining and fostering the platform’s growth.

Usages

At V1.0, users can:

- – Hold RSTK to participate in Restake Finance governance

- – Stake RSTK to earn a share of the protocol’s revenue

- – Stake RSTK to boost your EigenLayer native yields

- – Provide RSTK liquidity to access additional yield boost.

2) sRSTK → Tokenized form of staked RSTK.

It can be acquired either by staking RSTK tokens or through liquidity incentives. It maintains the same value and supply cap as RSTK but differs in that it cannot be traded or transferred. However, sRSTK holders are entitled to governance and revenue-sharing rights within the DAO.

To ensure alignment with long-term objectives, sRSTK comes with a mandatory 45-day vesting period. This period reinforces the commitment of holders to the protocol’s governance and shared revenue generation.

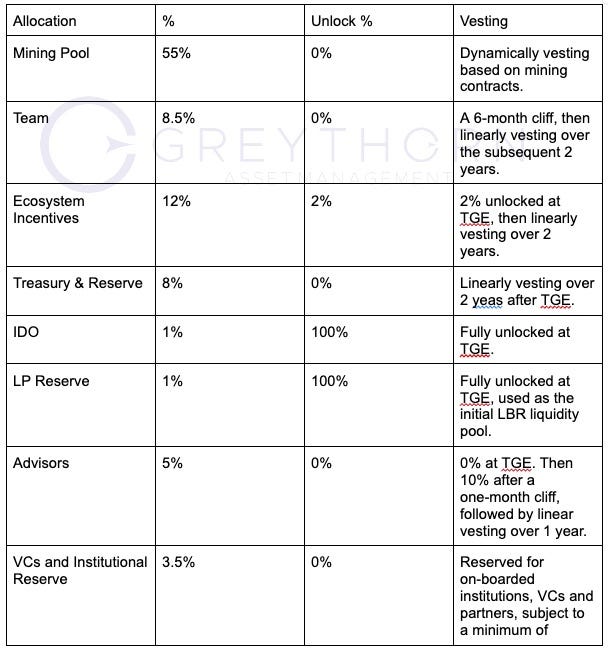

Distribution ($RSTK) :

Comparables/Competitors:

Restake Finance, leading the way in modular liquid staking with EigenLayer, uniquely stands in this space without direct rivals, particularly in token-based competition. EigenLayer’s role in this sector allows us to evaluate the Total Addressable Market (TAM). The focus here is on Layer 1 (L1) blockchains beyond Ethereum, specifically through actively validated services (AVSs).

From Q1 2020 to Q4 2022, staking rewards for top Proof of Stake (PoS) networks outside Ethereum showed a remarkable 140% Compound Annual Growth Rate (CAGR). Despite a significant market drop in 2022, the three-year CAGR still impresses at 37%, underscoring the growth potential in this early-stage sector.

By 2022’s end, staking rewards for the top 25 PoS chains reached about $3 billion, with projections suggesting this could rise to over $25 billion by 2030, assuming a 37% CAGR. If EigenLayer captures 10% of these rewards, it faces a potential $2.5 billion market by 2030. The growth prospects for both current and new PoS systems are substantial, signaling a promising future for EigenLayer and Restake Finance in the dynamic blockchain and staking arena.

Roadmap:

Phase III: 2024

- – DeFi Integrations

- – Liquidity Optimization

- – Cross-chain

- – DAO Launch

- – V2 Development

- – Explore Orderbook AMMs

- – Bug Bounty Program

Bullish Fundamental Factors:

First-Mover Advantage: Restake Finance is the first protocol launching modular liquid staking for EigenLayer. As pioneers in modular liquid staking, particularly with EigenLayer’s unique approach, Restake Finance benefits from being early entrants in this niche. This position allows them to establish a strong brand, attract early adopters, and set industry standards.

Innovative Technology: This technology, which allows for restaking and modular staking solutions, represents a significant advancement in the staking ecosystem. This innovation can attract users seeking more flexibility and efficiency in staking operations.

Potential Market Size: The staking market, especially beyond Ethereum, is growing rapidly. With substantial staking rewards and increasing interest in PoS networks, the total addressable market for services like those offered by EigenLayer and Restake Finance is expanding.

Strong Revenue Model: With a model that potentially allows Restake to capture a percentage of staking rewards, there is a clear path to revenue generation, which is crucial for long-term sustainability.

Bearish Fundamental Factors:

Market Volatility: The cryptocurrency market is known for its high volatility. Significant fluctuations in market prices can affect the staking rewards and overall interest in staking platforms.

Regulatory Risks: The regulatory landscape for cryptocurrencies and blockchain technologies is still evolving. Potential regulatory crackdowns or unfavorable policies could negatively impact the operations of platforms like EigenLayer and Restake Finance.

Technical Challenges: As pioneers in a complex technological field, EigenLayer and Restake Finance may face unforeseen technical challenges.

User Adoption Hurdles: Convincing users to switch from traditional staking methods or other platforms to EigenLayer and Restake Finance may be challenging, especially if users are wary of new technologies or platforms.

Lybra Finance ($LBR)

Project Name: Lybra Finance

Project Type: LSDFi

Ticker: $LBR

Cryptocurrency Rank #: 781

Market Cap: $27.7m

Fully Diluted Valuation: $54.6m

TVL: $296m

Project Overview:

Lybra, a decentralized platform, focuses on stabilizing the cryptocurrency market through Liquid Staking Derivatives (LSD). It uses Lido Finance’s ETH proof-of-stake and stETH. The platform offers a unique stablecoin, eUSD, backed by ETH assets, which generates stable interest for its holders. Users receive a stable income from eUSD, sourced from the LSD income of their deposited ETH and stETH. When users deposit ETH or stETH and mint eUSD, they earn an income in stETH, which is then converted to eUSD and distributed to them.

Lybra Finance opted for an Initial DEX Offering (IDO) instead of traditional venture capital funding, successfully raising $480k with a return on investment (ROI) of 11.89x.

Users can currently benefit from a ~6.43% APY.

- Lybra V2:

In July/August 2023, Lybra Finance launched peUSD, an Omnichain DeFi version of eUSD, enhancing its ecosystem. The V2 update allows for a wider range of Liquid Staking Tokens (LSTs) like rETH and WBETH as collateral for eUSD and peUSD, increasing flexibility. A notable V2 feature is converting eUSD to peUSD while keeping accrued interest, benefiting protocol stability and flash loan use.

This update empowers esLBR token holders with DAO governance participation and introduces new revenue streams, including service and repayment fees benefiting esLBR holders, alongside innovative Bounty programs and a Stability Fund for eUSD’s peg maintenance.

Tokenomics:

LBR is an ERC-20 token with a capped supply of 100 million, enabling functions like staking, governance, and rewards for minting and liquidating.

LBR price at 09/01/2024: $1.10

Circulating Supply: 24,949,715

Total Supply: 49,173,734

Max Supply: 100,000,000

Networks: Arbitrum (ARB), Ethereum (ETH)

Token Allocation:

Token Utilities:

Governance with esLBR: Holders of esLBR actively participate in shaping the Lybra Protocol’s direction and development.

Yield Enhancement: esLBR holders receive 100% of the protocol’s revenues, boosting their earning potential.

Ecosystem Incentives: The Lybra Ecosystem offers rewards and grants to encourage contributions from various participants.

Resource Management: Strategic handling of treasury and revenue ensures a sustainable, resilient ecosystem.

esLBR is escrowed LBR, holding the same value and subject to LBR’s total supply. It can’t be traded or transferred but grants voting rights and a share in protocol earnings. It’s mainly acquired through mining rewards:

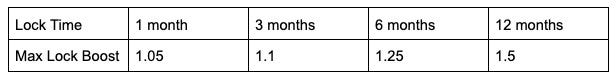

esLBR holders can convert their tokens to LBR over a 90-day linear vesting period and locking LBR or esLBR boosts esLBR emissions by up to 1.5x from incentive pools.

Roadmap / Key Highlights for Lybra Finance in 2024:

- Expansion to L2, perpetual exchange development.

- Lybra Wars Phase 2

- New Lybra Grants

- Expanded LST collateral

- New partnerships

- DAO — driven proposals

- Automated loan repayments

Comparables/Competitors:

As of the current data, Lybra Finance (LBR) holds a significant position in the LSD TVL (Total Value Locked) market, with a share of $294.81 million, which accounts for 18.087% of the market. Additionally, there is a substantial amount of stETH, totaling $16,538,780, deposited within this ecosystem.

Since Lybra introduced the version 2 update, it has emerged as a leading protocol in the LSDfi space, particularly for lending. Therefore, let’s compare the current variety of protocols in this domain, including Lybra, Prisma, and Raft.

Bullish Fundamental Factors:

- The LSDfi space is still new and growing.

- Lybra stands out because it can work across multiple chains, giving it access to a bigger market.

- Lybra’s approach of sharing all its revenue helps align the interests of both its holders and users with the protocol’s success.

- It also appears that Lybra is more appealing to a broader audience, with its simpler concept of borrowing a stablecoin that earns interest and lower leverage options

Bearish Fundamental Factors:

- Its bug bounty is rather small for its TVL size.

- The young nature of the sector could also pose a risk. If stronger competitors emerge, offering better rates, more features, or enhanced security, Lybra Finance might lose market share.

References:

Prisma Finance

Prisma Protocol. (n.d.). Prisma Protocol — Company. Prisma Protocol. Retrieved January 08, 2023, from: https://docs.prismafinance.com/

Prisma Protocol Twitter Account. (n.d.). Prisma Protocol — Company Socials. Retrieved January 08, 2023: https://twitter.com/PrismaFi/status/1663908241481318403

Restake Finance

Restake Finance Protocol. (n.d.). — Company. Restake Protocol. Retrieved January 08, 2023, from: https://restakefinance.com/

Lybra Finance

Lybra Finance Protocol. (n.d.). Lybra Protocol — Company. Retrieved January 08, 2023, from: https://docs.lybra.finance/lybra-finance-docs-v2/background/introduction

Dune Analytics (n.d) Lybra Finance Stats. Retrieved January 08, 2023, from : https://dune.com/lybra-finance/lybra-finance

Important notice and disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser. This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.