What is Aerodrome?

Built on Coinbase’s Layer 2, Base, which launched on the 9th of August, Aerodrome Finance is a DEX that was launched by Velodrome, one of OP’s most prominent decentralised trading venues with over $120m in TVL. Aerodrome launched towards the end of August on the 28th, acting as a liquidity engine and hub operating within four key steps:

- Trade: Fees are generated by a variety of trading activities across the platform.

- Emissions: Liquidity providers receive AERO emissions. This amount will be based on the votes the liquidity pool receives.

- Vote: AERO holders can lock their coin to receive veAERO, which they use to vote during each epoch.

- Rewards: veAERO holders will then receive various rewards such as incentives and fees from the pools they have voted for.

How does it work?

Decentralized exchanges encounter a common challenge where rewards are tied to total liquidity rather than trading volume, which generates fees for the protocol. To address this, solutions like Aerodrome offer a unique approach. They allow AERO token holders to lock their tokens for varying durations, ranging from one week to four years, in exchange for veAERO, a vested AERO token.

The duration of the lock directly impacts the amount of veAERO granted to the user, consequently increasing their influence in governance decisions. This mechanism mirrors the one used by Velodrome.

These locked veAERO tokens are represented as NFTs, which can be freely traded on various NFT marketplaces. This approach enables other users to acquire direct exposure to the ecosystem without the need to purchase tokens, lock them, and manage positions.

Holders of veAERO tokens can actively participate in platform governance, with the added benefit of helping establish reward levels for trading pools on the platform. In return, these voters receive 100% of the fees and incentives generated by the specific pools they’ve supported.

These innovative features create a self-sustaining cycle of liquidity. Users are drawn to the platform by the allure of rewards, which, in turn, leads to increased AERO token purchases. These active users play a crucial role in shaping the platform by voting on which project tokens to back, expand, and further reward. $veAERO can even be locked by the projects themselves to provide an incentive for voters to vote for them (hence driving more interest toward their liquidity pool/s).

The results of this approach have been promising. Velodrome, the Optimism project, has reported platform revenues exceeding $3m during the beginning of Q3, with $1.30m distributed as fees to VELO holders and users.

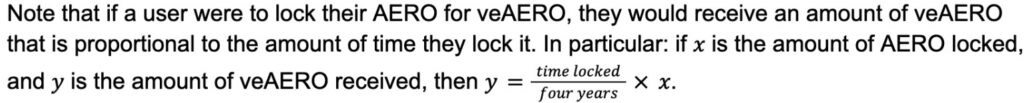

Token Summary

Figure 1: Aerodrome Finance Stats, Source: Greythorn Research Team, Data: CoinGecko, DefiLlama

Supply Schedule

The initial token distribution began with the release of 500M tokens (450M of which were veAERO tokens). Weekly emissions then began at 2% of the initial supply per week, with a 3% increase per week up until the 14th week since release. After this, they will decrease by 1% per week until emissions are below 9M per week. Once this occurs, voters must choose each week whether: a. emissions will decrease by 0.01% of total supply that week; b. emissions will increase by 0.01% of total supply that week; c. emission rates will remain unchanged that week.

Figure 2: Aerodrome Token Emissions, Source: Aerodrome Docs

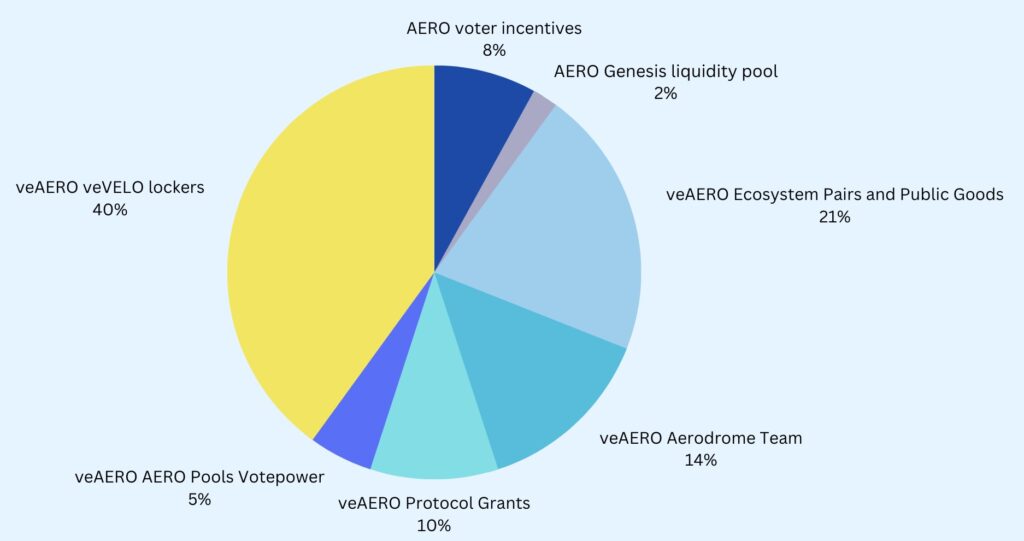

Tokenomics (Initial)

Figure 3: Aerodrome Tokenomics (Initial), Source: Greythorn Research Team, Data: Aerodrome Medium

Competitive Landscape

- BaseSwap | TVL: $10.01m

BaseSwap is a decentralized exchange (DEX) on Base Chain, designed for the Base community. It focuses on key attributes:

BaseSwap offers a decentralized trading experience, allowing users to trade from their Coinbase wallets while maintaining ownership and control of their assets. The DEX introduces a unique feature: real yield. Users can earn tangible cryptocurrencies using the $BSWAP and $BSX tokens, derived from protocol-generated swap fees. The Smart Order Routing system optimizes trade prices while minimizing gas fees. Operating on Base Chain results in reduced transaction costs compared to other blockchains. The user interface is user-friendly, making token swaps, liquidity provision, and farming participation accessible with a few clicks. BaseSwap serves as a user-centric DEX for the Base community.

Providers earn liquidity tokens as a proportion of the amount of liquidity they have provided to the pool, with providers to new pools earning amount of token A provided amount of token B provided. As of yet, there is no voting system. 、

Figure 4: BaseSwap TVL (Blue), Fees (Yellow) & New Users (Turquoise), Source: DefiLlama

- DackieSwap | TVL: $595k

DackieSwap is a decentralised exchange native to Base that similarly allows users to farm, amongst other things. It uses a CLMM (Concentrated Liquidity Market Maker) as opposed to an AMM (Automated Market Maker), allowing users to concentrate their liquidity for certain prices of the tokens. As of yet, there is also no voting system.

Figure 5: DackieSwap TVL (Blue) & Fees (Yellow)), Source: DefiLlama

Bullish Fundamentals

- Protocols on Base may be quite dependent on Aerodrome, particularly if they are somewhat new. Since they must essentially purchase $AERO (to buy $veAERO) if they would like to use the AMM to drive liquidity, then this will drive significant flow into $AERO.

- veAERO voters can control the emission rate weekly after a certain period of time – this would most likely ensure that emissions occur at a rate that is preferable for AERO holders. Nonetheless, it should be noted that they only have control of ~0.02% of the initial supply per week, limiting the strength of this bullish fundamental.

- Modest Competitive Edge: Aerodrome’s pools are significantly larger & offer more favourable yields than those of its competitors.

- Brand Reputation: Launched by Velodrome, Optimism’s second-largest DEX, the team boasts a well-known reputation for developing successful products & gaining respectable traction.

Bearish Fundamentals

- Since voters’ rewards will be dependent on the protocol they vote for, and liquidity providers’ rewards will be dependent on these votes, it is only natural to assume that votes and liquidity will only be provided to protocols that provide the best incentives or are likely to receive the most votes. Hence, this will likely not be very advantageous for ‘beginner’ protocols, or those starting out on Base (as the project suggests), since they may not be able to drum up a significant amount of capital if they do not have a significant amount to begin with.

- Locking AERO for four years in order to receive the same amount in veAERO may be considered too long for some users, and the project may also lack veAERO voters (on which it relies). However, do note that there are currently over 5000 veAERO voters with an average lock period of 3.99 years, however, note that this may be since 90% of the initial supply of AERO was already released as veAERO.

Figure 6: veAERO stats, Source: Greythorn Research Team, Data: @0xkhmer

Closing Remarks

Aerodrome functions as a liquidity hub within four key steps: trade, emissions, vote, and rewards. A unique feature allows AERO token holders to lock their tokens for varying durations, creating veAERO, a vested token. This veAERO can be used to vote and actively participate in platform governance. The locked veAERO tokens are represented as NFTs and can be traded on various NFT marketplaces, granting users direct exposure to the ecosystem.

This innovative approach creates a self-sustaining cycle of liquidity, with users drawn by the allure of rewards. The results have been promising, with substantial revenues and fees distributed to VELO holders and users. While competitive DEXs like BaseSwap and DackieSwap exist, Aerodrome boasts the advantages of significant liquidity and favourable yields. With support from Velodrome, the team’s reputation is another strength. However, it’s important to note the potential challenges, including dependence on rewards, long lock periods, and the need to attract and retain veAERO voters.

References

- @0xkhmer. (n.d.). Aerodrome Protocol Metrics ✈️. Dune dashboards. Retrieved October 24, 2023, from https://dune.com/0xkhmer/aerodrome

- AerodromeFi. (2023, August 4). Aerodrome: Launch & Tokenomics. Fueling Up: Base foundations have been… | by AerodromeFi | Aug, 2023. Medium. Retrieved September 19, 2023, from https://medium.com/@aerodromefi/aerodrome-launch-tokenomics-30b546654a91

- Aerodrome Finance. (n.d.). Aerodrome Finance. Aerodrome Finance. Retrieved September 18, 2023, from https://aerodrome.finance/

- Aerodrome Finance. (n.d.). Liquidity. Aerodrome Finance. Retrieved October 24, 2023, from https://aerodrome.finance/liquidity?filter=default&sort=apr&asc=false&page=1

- Aerodrome Finance Price: AERO Live Price Chart & News. (n.d.). CoinGecko. Retrieved October 24, 2023, from https://www.coingecko.com/en/coins/aerodrome-finance

- BaseScan. (n.d.). Aerodrome Token Holders. BaseScan. Retrieved September 19, 2023, from https://basescan.org/token/tokenholderchart/0xEF368EE138c92A24b90Da0Ad9c762342CD548776

- BaseSwap. (n.d.). Home | BaseSwap. Retrieved September 19, 2023, from https://baseswap.fi/

- BaseSwap. (n.d.). DefiLlama. Retrieved October 24, 2023, from https://defillama.com/protocol/baseswap

- BaseSwap. (2023, August). Liquidity Pool – BaseSwap. GitBook. Retrieved September 19, 2023, from https://base-swap-1.gitbook.io/baseswap/baseswap/liquidity-pool

- Binance Academy. (2023, September 7). What is BASE, Coinbase Layer 2 Network? Binance Academy. Retrieved September 18, 2023, from https://academy.binance.com/en/articles/what-is-base-coinbase-layer-2-network

- Binance Academy. (2023, September 7). What is BASE, Coinbase Layer 2 Network? Binance Academy. Retrieved September 19, 2023, from https://academy.binance.com/en/articles/what-is-base-coinbase-layer-2-network

- Blackstone, T. (2023, August 9). Base network has officially launched: Here’s how it can be used. Cointelegraph. Retrieved September 19, 2023, from https://cointelegraph.com/news/coinbase-base-network-officially-launched-heres-how-it-can-be-used

- CoinMarketCap. (n.d.). BaseSwap price today, BSWAP to USD live price, marketcap and chart. CoinMarketCap. Retrieved October 24, 2023, from https://coinmarketcap.com/currencies/baseswap/

- CoinMarketCap. (n.d.). DackieSwap price today, DACKIE to USD live price, marketcap and chart. CoinMarketCap. Retrieved October 24, 2023, from https://coinmarketcap.com/currencies/dackieswap/

- DackieSwap. (n.d.). Farms. DackieSwap. Retrieved October 24, 2023, from https://www.dackieswap.xyz/farms?chain=base

- DackieSwap. (2023, August). CLMM. DackieSwap. Retrieved September 19, 2023, from https://docs.dackieswap.xyz/products/product-features/liquidity-providers/clmm

- DefiLlama. (n.d.). Aerodrome. DefiLlama. Retrieved October 24, 2023, from https://defillama.com/protocol/aerodrome

- DefiLlama. (n.d.). DackieSwap. DefiLlama. Retrieved October 24, 2023, from https://defillama.com/protocol/dackieswap

- DEXTools.io. (n.d.). AERO / USDbC. DEXTools.io. Retrieved September 19, 2023, from https://www.dextools.io/app/en/base/pair-explorer/0x2223f9fe624f69da4d8256a7bcc9104fba7f8f75

- Pools. (n.d.). BaseSwap. Retrieved October 24, 2023, from https://baseswap.fi/pools

- TradingView. (n.d.). BSWAP_TVL Charts and Quotes — TradingView. TradingView. Retrieved September 19, 2023, from https://www.tradingview.com/symbols/BSWAP_TVL/

- Vold, F. (2023, August 29). Velodrome to Introduce Aerodrome DEX on Coinbase’s Base Network. Crypto News. Retrieved September 19, 2023, from https://cryptonews.com/news/velodrome-introduce-aerodrome-dex-coinbases-base-network.htm

Important notice and disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser. This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.