Market Summary

- BTC is down 68% from all-time highs.

- BTC is ranging between $18,910 and $22,530.

- Vol increased from 90% to 118% before declining back to 91% post-US CPI.

- Significant price levels:

- Support: $18,000 and $16,000.

- Resistance: $21,500, $23,000 and $24,000.

- Combining technical levels with our option flow model, we are expecting Bitcoin’s price to range between $16,800 and $23,250 over the next week.

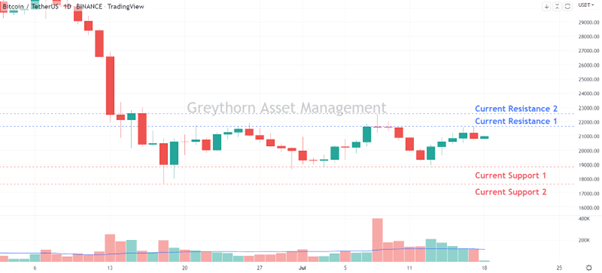

TECHNICAL LEVELS

Bitcoin ranged between $18,910 and $22,530 over the last fortnight. It reached a local high of $22,527 on the 8th of July, which was 2.7% higher than the resistance level that we called in our previous newsletter and then began to return below $21,900 in the hours to follow. $18,750, mentioned in our previous newsletter, is continuing to hold as a strong support as Bitcoin failed to break down this level on the 1st, 2nd, 3rd and 13th of July.

Regarding volatility, vol increased from 90% to 118% over the last fortnight before decreasing back to its current level of 91.28%. Downside risk was the main focus during last week’s US CPI announcement which is why the market saw a collapse in implied vols after the announcement as participants unwinded their hedges & uncertainty was removed from the market.

We forecast that Bitcoin will range between $17,600 and $22,500 over the following week.

- The first support level is at ~$18,750, followed by the second support level, which was also a recent low, at approximately $17,600.

- The first resistance level is at ~$21,700, followed by a second resistance level at approximately $22,500.

For more information regarding support and resistance levels, please refer to Support (Support Levels): https://www.investopedia.com/terms/s/support.asp and Resistance (Resistance Levels): https://www.investopedia.com/terms/r/resistance.asp.

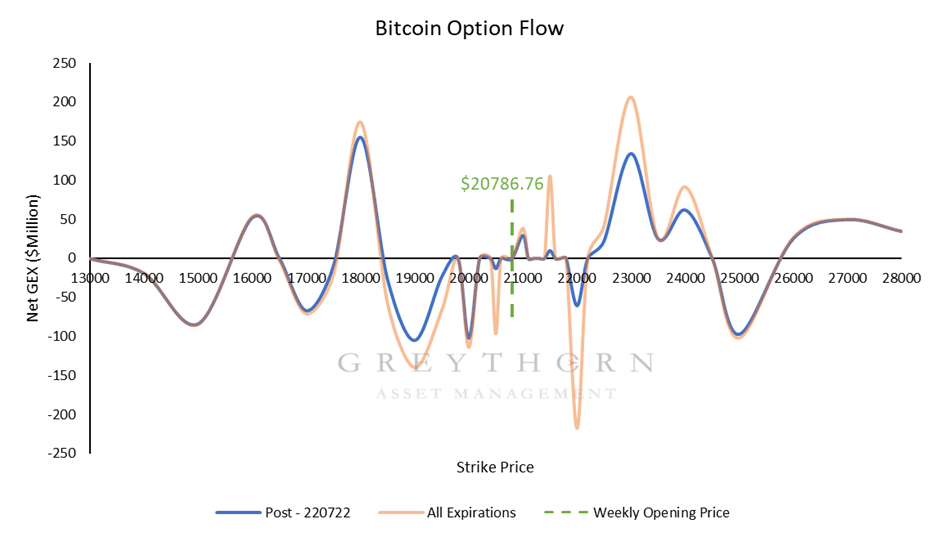

GREYTHORN OPTION FLOW MODEL

Greythorn’s view of markets is significantly dependent on supply & demand mechanics. As crypto markets mature & attract large flows of capital, their derivatives markets also grow. Derivatives markets tend to have a large influence on their underlying assets as market participants tend to hedge their exposure through spot & futures markets. Our proprietary option flow model has been developed in-house to inform our judgement regarding how positioning across derivatives markets may influence the movement of Bitcoin.

Bitcoin’s price has increased from $20,787 to ~$23,000 during this week.

Increased volatility is expected at a series of price levels that have negative net GEX, namely $15,000, $17,000, the interval between $19,000 and $20,500, and $22,000.

If price increases, $21,500 is a weak resistance, while $23,000 and $24,000 can be seen as stronger resistance levels, similar to the resistances of last week. If price decreases, $18,000 can be seen as the first strong support level, followed by $16,000 as the second support should price drop further.

After the release of US CPI numbers last Thursday, crypto option markets experienced significant activity before and after the announcement. Notably, BTC open interest (OI) of the two largest crypto options exchanges, Deribit and OKX, fluctuated considerably.

For OKX, within 10 hours on July 14, OI initially stretched 10x to roughly 750,000 and then plunged back lower than its original level. Deribit’s OI dropped ~18,000 to 202,200 (-8.34%) within an hour from 7:30 to 8:30 UTC on July 15th and gradually recovered back.

In summary, Greythorn views that Bitcoin will range between $16,000 and $24,000 based on our option flow model. In conjunction with our technical analytics, both techniques display that the market is expected to be more fragile over the following week than the past week, suggested by a positive yet lower GEX value.

For an introduction to Greythorn’s Option Flow Model, please refer to our newsletter from 22nd June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter-45f