MARKET SUMMARY

- Bitcoin & Ethereum are down ~17% & ~21%, respectively, over the past fortnight.

- Jackson Hole: Powell’s speech on higher rates bringing pain to households & businesses caused a global sell-off across risk assets, with $BTC & $ETH closing down ~6% & ~11%, respectively, on the day.

- FTX is set to list $GMX Spot.

- Coinbase launches Coinbase Wrapped Staked ETH (cbETH) ahead of the Merge, coupled with the addition of Nano Ether Futures to its derivatives platform.

- Traditional markets, the S&P 500 & Nasdaq 100, are down 5.60% & 7.72%, respectively, over the past fortnight.

- Greythorn views that Bitcoin will remain between $18,000 and $24,000 over the upcoming week.

GREYTHORN OPTION FLOW MODEL

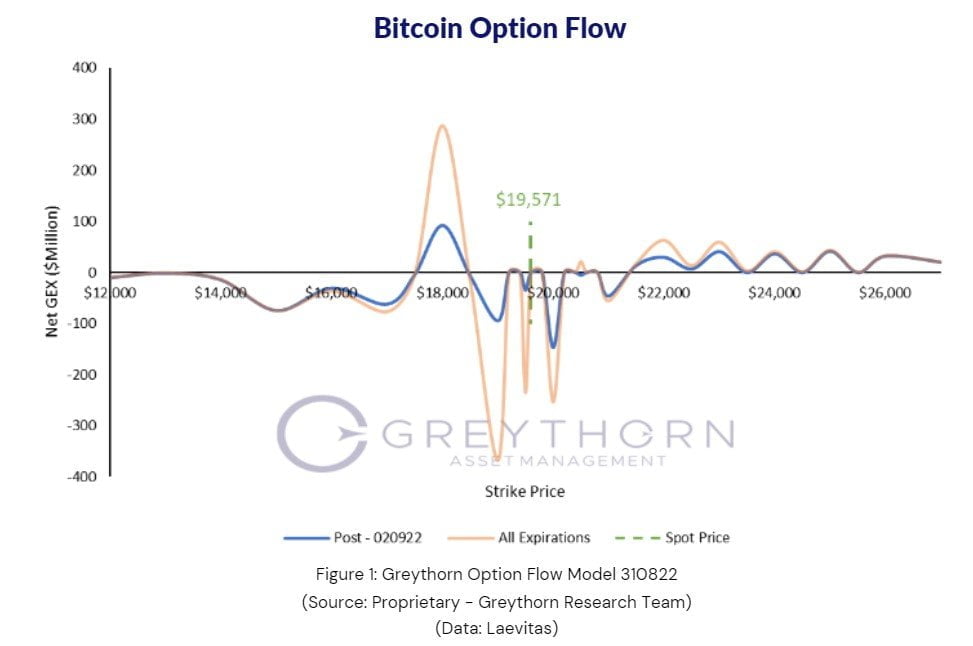

After the risk-off developments over the past weekend due to Fed Chair Jerome Powell’s comments about future monetary policy, Bitcoin opened at $19,571 on Monday.

Option supply decreased dramatically following last week’s monthly OpEx, indicating more illiquidity over the coming weeks.

Stagflationary developments will begin to gain the spotlight as policymakers recently approved further fiscal stimulus in the form of student debt forgiveness, coupled with Powell’s comments about the pain businesses must endure to bring down inflation.

Labour market indicators, such as the U.S. CB Consumer Confidence (Aug) and Initial Jobless Claims, are set to be released on Aug. 31st & Sep. 1st, respectively.

Increased volatility can be expected at a series of price levels with negative gamma supply, namely the interval between $14,000 to $17,000 and $19,000 to $20,000.

If prices continue to decline, $18,000 is the only significant support level in the short term. Should markets rally, $20,500 can be regarded as a weak resistance level, which will weaken after this week’s expiration on Sep. 2nd , with $22,000, $23,000, $24,000, $25,000, and $26,000 as further levels of liquidity.

Greythorn believes that Bitcoin will range between $18,000 and $24,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter

DISCLAIMER

Greythorn’s view of markets is significantly dependent on supply & demand mechanics. As crypto markets mature & attract large flows of capital, their derivatives markets also grow. Derivatives markets tend to have a large influence on their underlying assets as market participants tend to hedge their exposure through spot & futures markets. Our proprietary option flow model has been developed in-house to inform our judgement regarding how positioning across derivatives markets may influence the movement of Bitcoin.