MARKET SUMMARY

- Bitcoin & Ethereum are down 12% & 25%, respectively, over the past fortnight.

- The Cosmos 2.0 whitepaper was revealed on Monday, citing interchain security, major new structures for the Cosmos Hub, and a new issuance model for the $ATOM token.

- Crypto market maker Wintermute suffered a $160m DeFi exploit last Tuesday. The firm still owes $200m in outstanding DeFi debt to several counterparties but has reassured its community that its OTC business has not been affected.

- US interest rates increased 75 basis points at last week’s FOMC conference.

- Traditional markets, the S&P 500 & the Nasdaq 100, are down 10.7% & 10.9%, respectively, over the past fortnight.

- Greythorn views that Bitcoin will remain below $23,000 over the upcoming week.

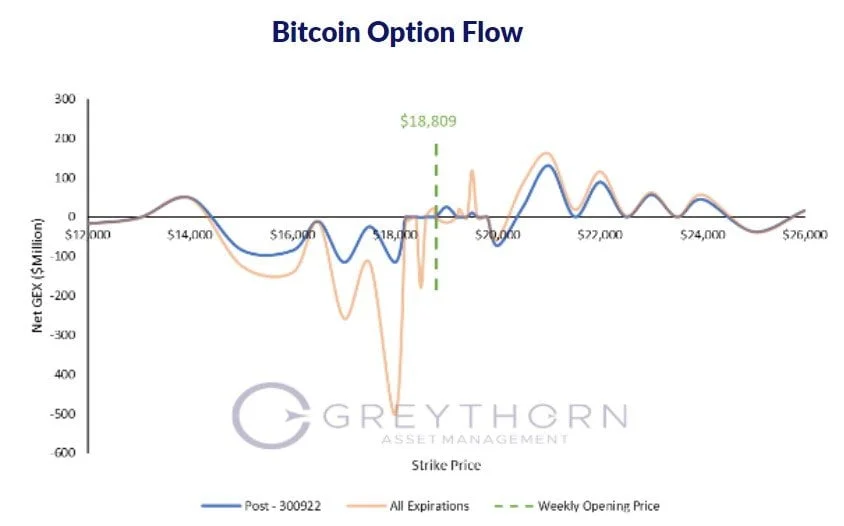

GREYTHORN OPTION FLOW MODEL

After the plunge over the past weekend, Bitcoin opened at $18,809.

Increased volatility is expected at a series of price levels with negative option supply, namely the intervals between $15,000 & $18,500, and $20,000 & $25,000.

- If the price decreases, $18,750 is the next significant support, followed by $14,000 as a relatively weak level of support.

- If the price increases, the first resistance is $19,500, which is set to weaken after this week’s expiration. $21,000 and $22,000 are the following levels of significant resistance.

Gamma Supply has turned from positive to negative, indicating that the market will remain relatively fragile over the coming week. Downside liquidity remains relatively low, especially given the considerable amount of hedging that can take place at $18,000. US Fed Chair Powell will deliver two speeches on Tuesday and Thursday, while US & UK GDP data is set to be released on Thursday and Friday, respectively. These events, coupled with a notable decrease in OI after this week’s quarterly expiration, pose a catalyst for volatility to catch a bid into the end of the week.

Greythorn believes that Bitcoin will range below $23,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter

DISCLAIMER

Greythorn’s view of markets is significantly dependent on supply & demand mechanics. As crypto markets mature & attract large flows of capital, their derivatives markets also grow. Derivatives markets tend to have a large influence on their underlying assets as market participants tend to hedge their exposure through spot & futures markets. Our proprietary option flow model has been developed in-house to inform our judgement regarding how positioning across derivatives markets may influence the movement of Bitcoin.