Market Summary

- Bitcoin & Ethereum are up 3.39% & 10.4%, respectively, over the past fortnight.

- Fidelity is set to provide its clients access to Ethereum trading. The service is expected to launch on October 28th.

- US CPI came in at 8.2% for September, above estimates of 8.1%.

- Bank of New York Mellon has added cryptocurrencies to its custody services.

- Google has partnered with Coinbase to accept crypto payments for Cloud services & also use its custody service, Coinbase Prime.

- Traditional markets, the S&P 500 & the Nasdaq 100, are up 5.81% & 5.62%, respectively, over the past fortnight.

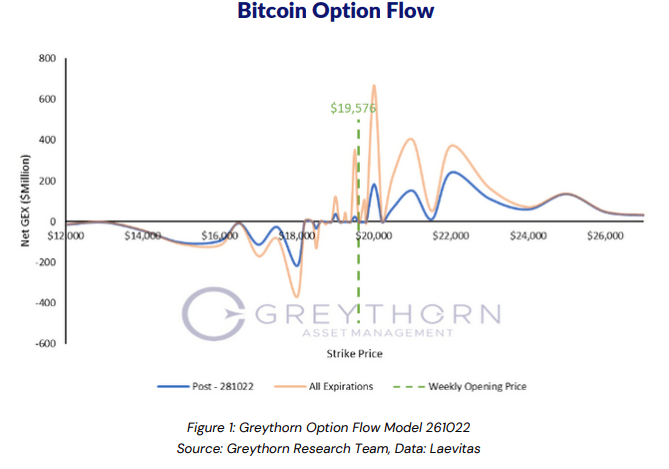

- Greythorn views that Bitcoin will range between $19,000 and $21,000 over the upcoming week based on our option flow model.

Greythorn Option Flow Model

Bitcoin rebounded over the past weekend, with both implied & realised vols hovering at multi-year lows. Opening at $19,576, investors will begin preparing for this week’s monthly OpEx, followed by the November 2nd FOMC.

Increased volatility is expected at a series of price levels with negative gamma supply, namely the interval between $12,000 and $18,500, particularly at $18,000.

If price decreases, $19,500 is a significant support, while $19,250 and $19,000 can be seen as relatively weak supports.

To the upside, the first resistance is at $19,750, followed by $20,000 as the most considerable level of resistance for this week. $21,000 is next, and the entire interval between $22,000 and $27,000 can be considered an area of increasing liquidity.

Option supply substantially increased over the past week, indicating more sideways action with less crash risk for the following week. This is observed in the figure above with the magnitude of gamma at current levels, particularly $20,000. Considering US GDP is set to be released tomorrow, followed by EU, Japanese and German inflation data, participants should note that increased volatility may be present around these releases.

Greythorn believes that Bitcoin will range between $19,000 and $21,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter

DISCLAIMER

Greythorn’s view of markets is significantly dependent on supply & demand mechanics. As crypto markets mature & attract large flows of capital, their derivatives markets also grow. Derivatives markets tend to have a large influence on their underlying assets as market participants tend to hedge their exposure through spot & futures markets. Our proprietary option flow model has been developed in-house to inform our judgement regarding how positioning across derivatives markets may influence the movement of Bitcoin.