BTC and ETH TL;DR

- Bitcoin & Ethereum are down by 4.51% & 1.25%, respectively, over the past fortnight.

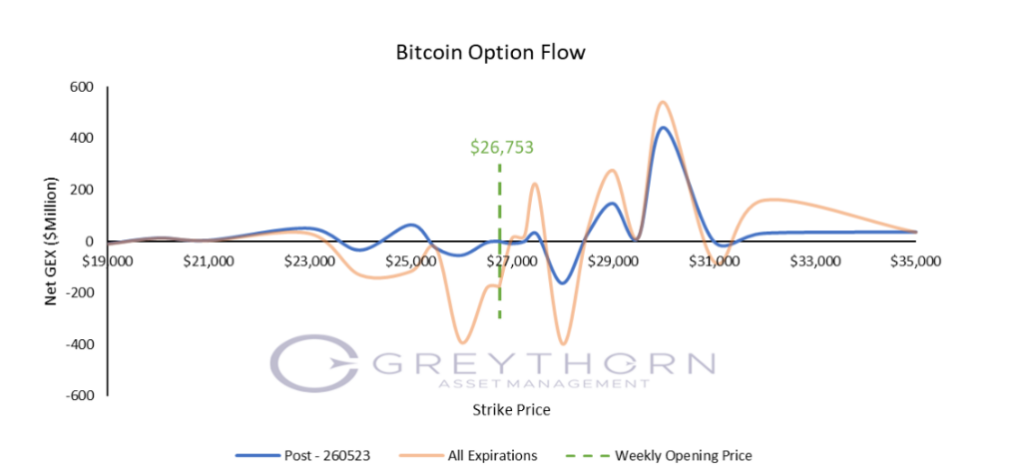

- Greythorn views that Bitcoin will trade between $23,000 and $30,000 over the upcoming week based on our option flow model.

Greythorn Flow Model:

Greythorn’s view of markets is significantly dependent on supply & demand mechanics. As crypto markets mature & attract large flows of capital, their derivatives markets also grow. Derivatives markets tend to have a large influence on their underlying assets as market participants tend to hedge their exposure through spot & futures markets. Our proprietary option flow model has been developed in-house to inform our judgement regarding how positioning across derivatives markets may influence the movement of Bitcoin.

Figure 1: Greythorn Option Flow Model 220423. Source: Proprietary – Greythorn Research Team. Data: Deribit.

Bitcoin has been hovering below $27,000 over the past week, after Fed Chair Powell’s dovish comments about easing back on rate hikes. With participants awaiting US GDP to be published on Thursday, Bitcoin opened at $26,753 on Monday morning.

From the perspective of option supply, increased volatility can be expected at several price levels, including $24,000, the interval between $26,000 to $27,000, $28,000 and $31,000.

If price retreats downwards, $25,000 will be the first weak support level it meets, followed by $23,000 as the second.

Several significant resistances can be found to the upside, including $27,000, $29,000 and $30,000 as notable levels should price increase. A resistance zone has formed from $32,000 to $35,000.

Gamma supply remains positive, however, is now only a mere two-thirds of the figure from the previous fortnight. This suggests that market conditions over the following week can still be considered relatively stable, yet the underlying liquidity available may indicate a changing market sentiment.

Apart from US GDP, several other macro indicators are set to be released this week. UK CPI, BoE Governor Bailey’s speech on Wednesday and Retail Sales on Thursday will be closely watched by market participants, along with German GDP on the same day. Meanwhile, any unexpected releases regarding US Crude Oil Inventories, Home Sales, and FOMC Minutes, may introduce market turbulence.

Greythorn believes that Bitcoin will trade between $23,000 & $30,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter

Important notice and disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstances, or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer, or other professional adviser. This presentation contains statements, opinions, projections, forecasts, and other material (forward-looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.