BTC and ETH TL;DR

- Bitcoin & Ethereum are up 0.23% and down 0.26%, respectively, over the past fortnight.

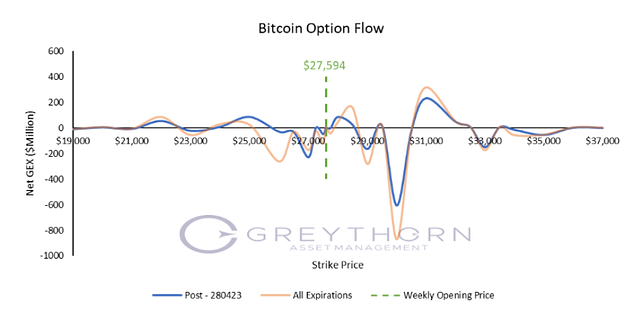

- Greythorn views that Bitcoin will trade between $25,000 & $31,000 over the upcoming week based on our option flow model.

Greythorn Option Flow Model

Greythorn’s view of markets is significantly dependent on supply & demand mechanics. As crypto markets mature & attract large flows of capital, their derivatives markets also grow. Derivatives markets tend to have a large influence on their underlying assets as market participants tend to hedge their exposure through spot & futures markets. Our proprietary option flow model has been developed in-house to inform our judgement regarding how positioning across derivatives markets may influence the movement of Bitcoin.

After the short covering that followed the Ethereum Shanghai upgrade on Apr.12th, crypto markets turned lower & eliminated the gains from the buildup. Breaking past the $30,000 support, Bitcoin opened at ~$27,600 and has been trading around this level for the past few sessions.

From the perspective of option supply, increased volatility can be expected at several price levels, including $26,000, $27,500, $29,000, $30,000 and $33,000.

If the price retreats further, two weak supports can be found at $25,000 and $22,000. If the price increases, $28,500 is the first resistance, followed by $31,000 as the second.

Gamma supply is still positive, but halved from the figure a fortnight ago, indicating more uncertainty over the following week. From the graph above, it can also be observed that the magnitude of liquidity-taking is larger than that of liquidity provision, particularly at $30,000.

Considering traditional market data points for large nations are to be released during the second half of the week, more volatility can be introduced to markets. US Crude Oil Inventories, GDP (Q1) and Initial Jobless Claims are scheduled for Thursday. The Monetary Policy for Japan along with the Unemployment Change, GDP (Q1) and CPI (Apr) of Germany are all scheduled for Friday, as well as the Manufacturing PMI of China on Sunday.

Greythorn believes that Bitcoin will trade between $25,000 and $31,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter

Important notice and disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser. This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.