Founded in 2017 and launched via IEO on Binance in March 2019, Fetch.AI is an artifical intelligence (AI) lab building an open permissionless, decentralised machine learning network with a cryto economy. Fetch.ai democratises access to AI technology with a permissionless network upon which anyone can connect and access secure datasets by using autonomous AI to execute tasks that leverage its global data network.

The foundation of Fetch.ai is the AEA framework introduced in its whitepaper. AEA is an acronym for Autonomous Economic Agents, a concept of digital twins of real individuals that can act on behalf of its users and earn economic benefits for them.

Agents are able to interact with other agents on the network to optimise given solutions. During the process, users can obtain Fetch tokens whenever others utilise or interact with their agents on the platform.

Token: $FET

TVL: –

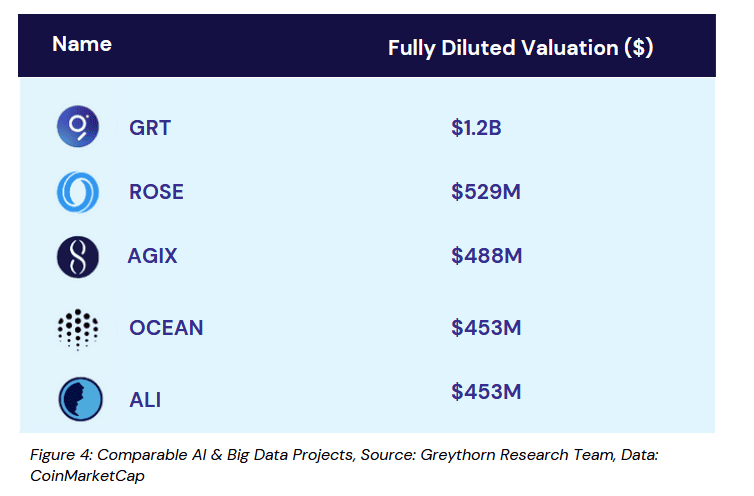

Market Cap: ~$255m

FDV: $282m

In the company’s vision, agents would be integrated with machine learning capabilities, and users could increase the capabilities of their agents using the Fetch token. The beta version platform is available by the name “Agentverse”, where users can deploy their agents following the four pre-constructed templates offered by Fetch.ai.

Use Cases:

- Find, create, deploy and train digital twins.

- Train autonomous digital twins and deploy collective intelligence on the network.

- Validation staking

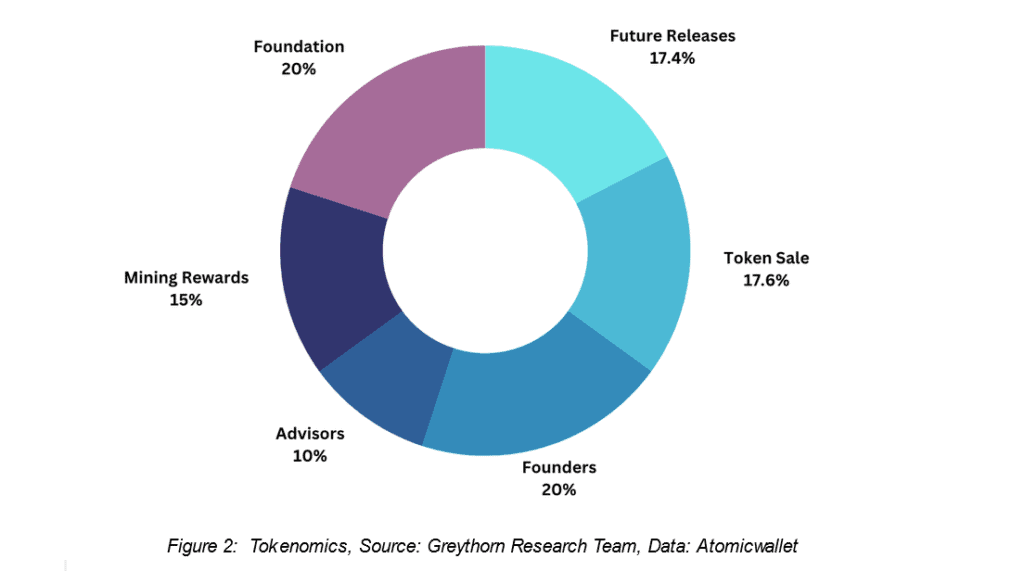

Tokenomics (Initial)

Bullish Fundamentals

- Increasing Investor Appetite: The emergence of ChatGPT has led to a sharp increase in investor appetite for AI. This trend has been observed across both traditional & cryptocurrency markets & remains a leading theme for the tech sector on a longer-term horizon.

- Industry Partners: Backed by real-world industry experts Bosch, their collaboration on a “functional blockchain network” that can be adopted in industry practice and later the collaboration with the Fetch.ai foundation provides a limited amount of feasibility to the project.

Bearish Fundamentals

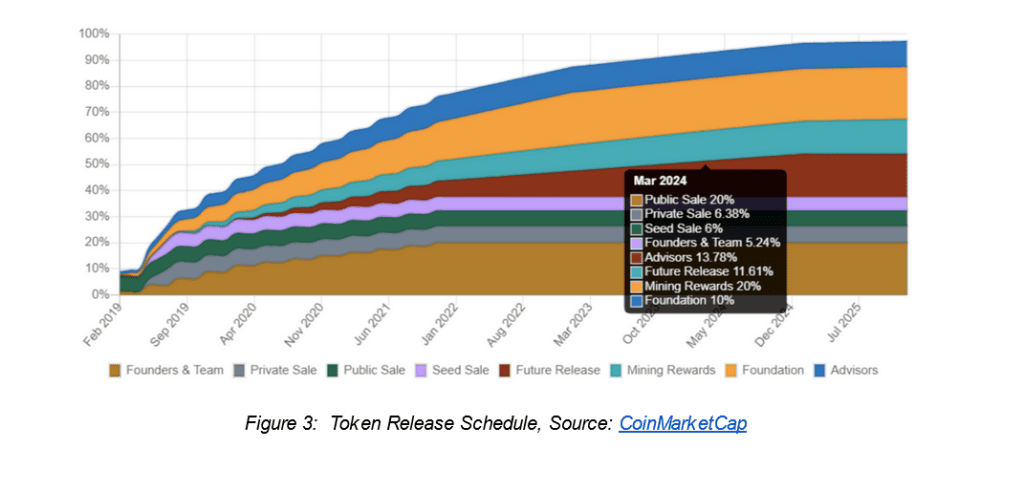

- Practicality: The practicality of AEA cannot be validated. Their documentation does not mention the project’s tokenomics and token release schedule.

- Limited AI Functionality: AI is only integrated into the Fetch wallet with limited functionality. On the token roadmap, AI is classified under separate sessions with Agents and may indicate a limited correlation between these concepts. Current progress on Colearn, Axim and DabbaFlow, three machine learning ecosystems for Fetch.AI have no plans for future integration into the agent network but are instead similar to separate projects.

- Shift to FinTech: Mattalex, the first application from Fetch.ai was a DeFi trading exchange platform, and their second project Atomix was an online lending platform both with no relation to AI.

- Minimal Use Cases: Fetch.ai promised $FET to be the gas that runs the Fetch network. However, the FinTech projects mentioned above use their own tokens. The upcoming decentralised machine-learning protocol and solutions provider, Colearn and Axim, have their own tokens as their predecessors.

- Centralised Data Storage: In the Q&A session of the Agentverse demo, CIO confirmed data was stored not on the ledger, but in a “Cassandra-like database” that is centralised.

Closing Remarks

Whether the vision told by Fetch.ai ultimately succeeds depends on whether they build a decentralised AI training model that allows individuals to use $FET tokens to train their own AI.

Currently, centralised machine learning and AI training can be resource-demanding, which a Binance article estimates ~$500m to train a large dataset AI model by 2030. Fetch.ai introduces an alternative to the larger model of the AI trend with a smaller, lower-cost AI model that can attain specific uses for individuals and enterprises.

References

- CoinMarketCap (2023) What is fetch.ai (FET)? features and tokenomics: CoinMarketCap, CoinMarketCap Alexandria. Available at: https://coinmarketcap.com/alexandria/article/what-is-fetch-ai-fet-features-tokenomics-and-price-prediction (Accessed: 09 May 2023).

- Fetch.ai Price Today, FET to USD live price, marketcap and Chart (2023) CoinMarketCap. Available at: https://coinmarketcap.com/currencies/fetch/ (Accessed: 09 May 2023).

- Infrastructure for smart, Autonomous Services (2023) Fetch Network. Available at: https://fetch.ai/ (Accessed: 09 May 2023).

- Metaversepost (2023) AI Model Training Costs Are Expected to Rise From $100 Million to $500 Million By 2030, Binance. Available at: https://www.binance.com/en-AU/feed/post/196608 (Accessed: 09 May 2023).

- Minarsch, D. et al. (2021) Autonomous Economic Agent Framework, Dropbox. Available at: https://www.dropbox.com/s/gxptsecwdl3jjtn/David%20Minarsch%20-%202021-04-26%2010.34.17%20-%20paper_21_finalversion.pdf?dl=0(Accessed: 09 May 2023).

- The Agentverse Discord Showcase | Blockchain AI | Fetch.ai (2023) YouTube. Available at: https://www.youtube.com/watch?v=Dut5lRfPBMM (Accessed: 09 May 2023).

- Vanian, J. and Leswing, K. (2023) Chatgpt and generative AI are booming, but the costs can be extraordinary, CNBC. Available at: https://www.cnbc.com/2023/03/13/chatgpt-and-generative-ai-are-booming-but-at-a-very-expensive-price.html (Accessed: 09 May 2023).

- What is fetch.ai (2023) Atomic Wallet. Available at: https://atomicwallet.io/academy/articles/what-is-fetch-ai-fet#:~:text=In%202022%2C%20Fetch.ai%20upgraded,multiple%20decentralized%20exchanges%20(DEX). (Accessed: 09 May 2023).

Important notice and disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser. This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee