zkLend is a money-market protocol built on StarkNet, combining ZK-rollup scalability, superior transaction speed, and cost savings with Ethereum’s security.

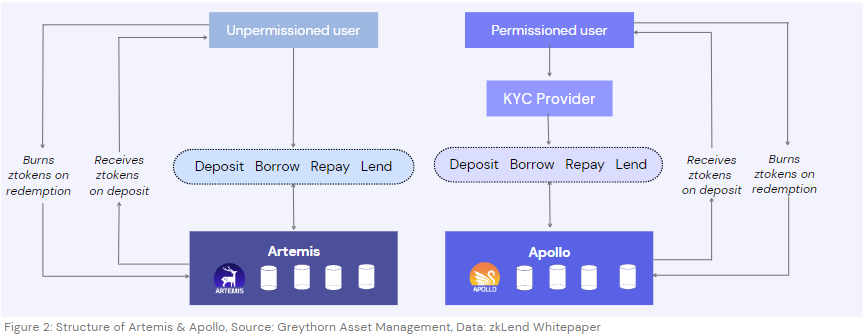

At its core, zkLend offers a dual suite of permissioned compliance-focused solutions for institutional clients (“Apollo”) and a permissionless service for DeFi users (“Artemis”).

Token Name: $ZEND (TBA)

- Accrues protocol fees

- Provides incentives for active participants

- A portion of borrowing fees are directed to reward borrowing/lending, LPs, community events & marketing/airdrop campaigns.

- ~20% of the protocol’s operating profit goes toward the treasury to be used for specific asset markets,

- 5% is for the safe module as a risk management tool to avoid any liquidity shortfalls (up to 30% of stZEND).

$stZEND

- Staking: Receive $stZEND at a 1:1 ratio with a 10-day cooldown period for converting back

- Current Features:

- Revenue Sharing

- Emission Rewards

- Governance Rights for both protocols on zkLend’s features

- Future Features: Membership Perks (discounts on borrowing/lending on Artemis)

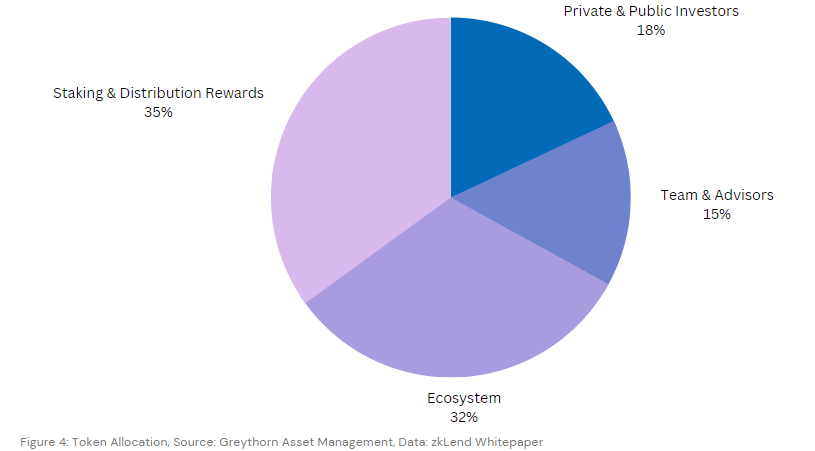

Tokenomics

Total Supply: 100,000,000 $ZEND

Current Investors

- Delphi Digital (Lead)

- StarkWare

- GBV

- CMS

- MetaCartel Venture

- Amber

Bullish Fundamental Factors

- As one of the first native money market protocols in the StarkNet ecosystem, the initial token issuance of the network (postponed since Sept.2022) as the single way for paying gas fees can potentially increase the usage of zkLend.

- Reduced Risks:

- Centralisation Risk (As the L2 solution, StarkNet extends the security and decentralised characteristic of Ethereum to its protocols),

- Oracle Risk: Partnered with Chainlink & Empiric,

- Market Volatility Risk: Isolated pool is set,

- Liquidity Risk: Liquidation process and safe module in use &

- Smart Contract Risk (Artemis codes are under auditions of ADBK and Nethermind before the mainnet is available).

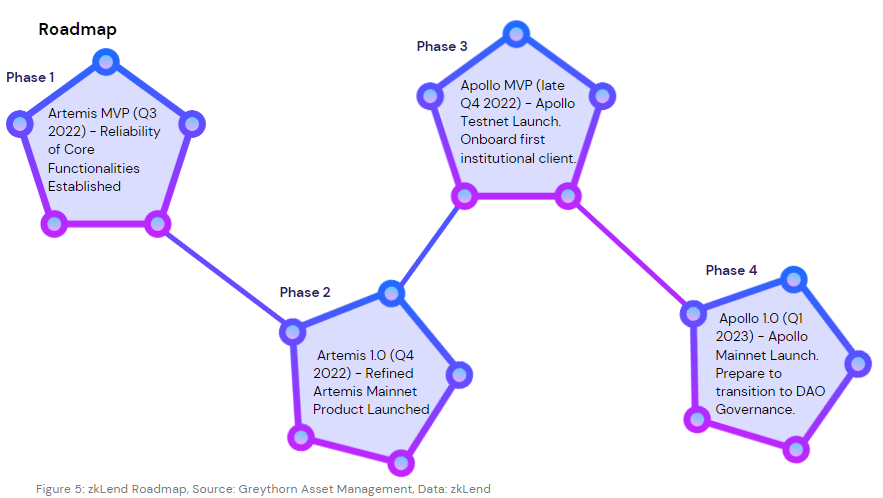

- $ZEND to IEO in Q4 2022/Q1 2023.

- Early-mover advantage

Bearish Fundamental Factors

- Apollo is on the roadmap to be delayed for approximately half a year.

- Apart from the ZK-rollup tech, the mechanical design of the protocol is relatively standard. (including categorising different assets into tiers, separating retailers/individual investors & institutions, etc.).

- Aave is set to begin growing into the StarkNet ecosystem after Phase 1 was passed on December 4th. This may limit the portion of the available market for zkLend to capture.

References

- AAVE – open source liquidity protocol (no date) An SVG of an eye. Available at: https://app.aave.com/governance/proposal/?proposalId=127 (Accessed: December 5, 2022).

- CoinGecko. 2022. Cryptocurrency Prices, Charts, and Crypto Market Cap | CoinGecko. [online] Available at: <https://www.coingecko.com/> [Accessed 29 November 2022].

- CoinMarketCap. 2022. Cryptocurrency Prices, Charts And Market Capitalizations | CoinMarketCap. [online] Available at: <https://coinmarketcap.com/> [Accessed 29 November 2022].

- DefiLlama. 2022. DefiLlama. [online] Available at: <https://defillama.com/> [Accessed 29 November 2022].

- zkLend. Available at: https://zklend.com/# (Accessed: December 2, 2022).

Important notice and disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser. This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.