What is Anchor?

Anchor Protocol is a savings protocol based on the Terra blockchain that allows depositors to earn 19.45% on their UST stablecoins with low volatility. It was launched on March 17, 2021 to increase the demand for UST, the native stablecoin for the Terra blockchain.

It acts as a money market where participants can lend and borrow stablecoins. Lenders deposit UST into the platform and borrowers provide collateralised assets in the form of Luna, Ethereum, or Cosmos. The collateralised assets, or bonded assets, are locked up in the protocol & UST deposits can be borrowed against them until Anchor’s borrowing limit.

To understand this process, it is necessary to analyse the protocol from the perspective of both borrowers & depositors to recognise where their incentives lie.

How does the deposit feature work, what is aUST and why is it powerful?

When individuals deposit UST into Anchor, they essentially buy aUST with UST. The aUST represents a depositor’s share of the UST in the Anchor pool and acts as an interest-bearing asset. The interest accrues through an increase in the value of aUST through the aTerraExchangeRate, which is (deposits+borrowing+accrued interest)/aUST Supply. The quantity of aUST held by an individual over time remains constant, but the aTerraExchangeRate, the rate at which you can sell aUST back into UST, increases at a current rate of 19.45% a year.

Anchor is powerful because aUST can be used as collateral to borrow assets while still earning interest on the collateral. A simple example would be if you were seeking to borrow your friend’s car for a month. Maybe your friend does not trust you to return the vehicle in good condition and asks you to deposit $1000 in return for borrowing the car. Instead of sending him $1000 and foregoing the opportunity for you to earn a return on that $1000 for the month, you instead send him $1000 worth of aUST. He is happy because he has some protection against the possibility that you return the car with a dent and refuse to pay for the damage. You are glad because you can use the vehicle for the month and still earn interest on your deposit.

Through other protocols within the Terra ecosystem, aUST can act as interest-bearing collateral can be used. For example, aUST can be used to gain leveraged exposure to price movements of real-world companies such as Google, Coca-Cola, or even the S&P 500 index.

However, since Anchor borrow rates have historically been higher than the earn rate, up to 14% higher, it leads to the question of why would a borrower accept a 14% borrow rate when they can borrow funds at sub 10% rates with other protocols such as Compound and Aave?

The reason borrowers have accepted higher rates in the past is that they are incentivised to borrow through ANC tokens.

The ANC token is Anchor Protocol’s governance token and essentially represents an individual’s ownership over Anchor Protocol. It allows holders to vote on governance polls and grants them a distribution of the Protocol fees. In return for borrowing on Anchor, borrowers earn ANC tokens which can be converted into UST. At current rates, the ANC rewards for borrowing equate to a distribution APR of 6.58%, lowering the effective net APR a borrower pays to 5.08%. At times, when the borrowing rate was at 30%, ANC emissions were increased to the point where the incentive to borrow was 40%+. This created the situation where borrowers were paid 10% to borrow from Anchor.

So, how does Anchor pay 19.45%?

Anchor generates cash flow from the lending interest and the income it earns from the staked assets (bAssets) provided as collateral. When the generated cash flow is less than the amount paid out to depositors, the shortfall is subsidised from the Yield Reserve, a reserve of UST held to ensure payouts to depositors can continue when incoming cash flow is less than outgoing cash flow.

When the ‘real yield’ or actual cash flow rate generated by Anchor’s loans and staking of bAssets is less than the ‘Anchor rate,’ the rate paid to depositors, the incentives to borrowers will increase by 50% a week until the two rates converge. The emissions of ANC tokens will grow exponentially until the reward for borrowing brings in enough borrowers to generate enough cash flow to pay depositors. If the ‘real yield’ is greater than the ‘Anchor rate,’ the difference will be stored in the yield reserve.

Currently, the ‘real yield’ generated by Anchor is 5.81%, while the Anchor rate is 19.45%. The yield reserve has decreased from $408M to $272M from March 20 to April 20, 2022.

How sustainable is Anchor moving forward?

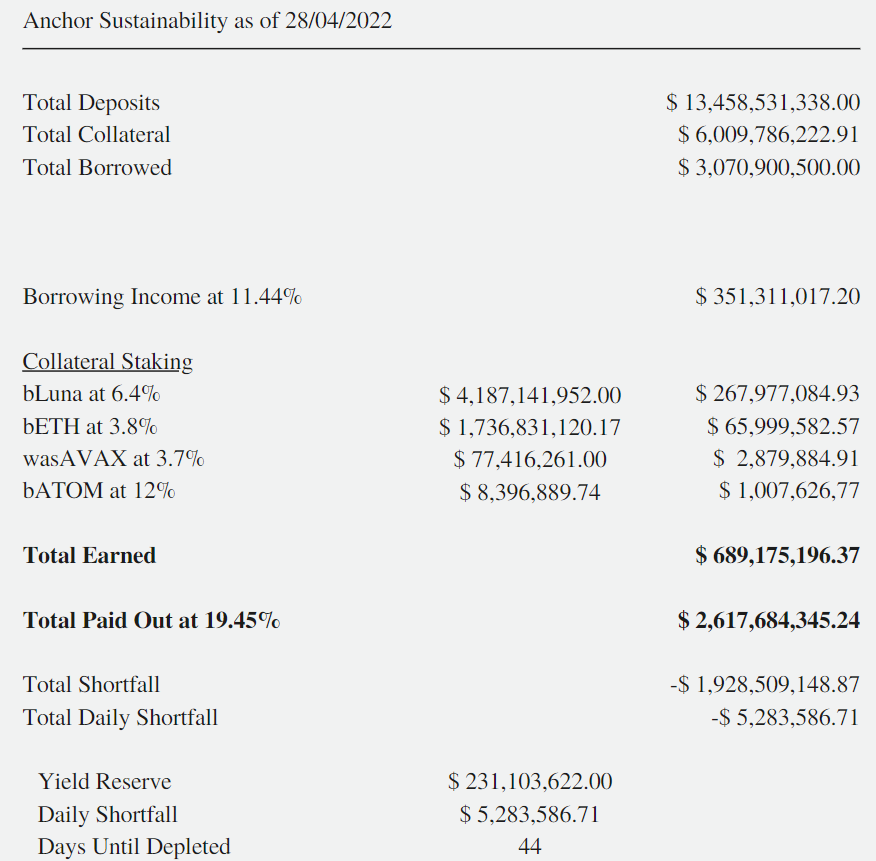

At current deposits of $13.5 billion at 19.45%, supplied collateral of $6 billion generating a weighted average of 5.95%, and borrowings of $3.07 billion at 11.44%, there is a daily shortfall of $5.28 million implying that the yield reserve will deplete in 44 days.

Figures as of April 28, 2022

Sources: app.anchorprotocol.com ‘Dashboard’, stake.lido.fi ‘Stake Ether’, pStake.finance ‘Cosmos’, Benqi.fi ‘Avalanche’.

Following a governance proposal that passed on March 24, 2021, ANC holders decided to implement a more sustainable semi-dynamic earn rate. Under the new system, the earn rate will adjust monthly by a maximum of 1.5% when the yield reserve appreciates or depreciates by 5% or greater. Therefore if the yield reserve decreases by at least 5% a month (currently ~50%), the deposit rate will drop to 18%, then 16.5%, 15%, until the yield reserve stabilises.

This change will only result in an effective earn rate of 19% being applied over the next two months resulting in the yield reserve depleting in 60 days, assuming no change to deposits or collateral and borrowing rates.

Anchor can currently sustainably pay an earn rate of 8% for one year with the current deposit/borrower ratio, and following one year, a rate of 5-5.5% is sustainable.

The sustainability of Anchor is entirely dependent on individuals being willing to provide collateral to Anchor and borrow UST in the long run. Due to the tokenomics of the ANC token, past 2025, there will no longer be ANC incentive rewards given to borrowers, and Anchor will need to maintain high borrowing levels organically.

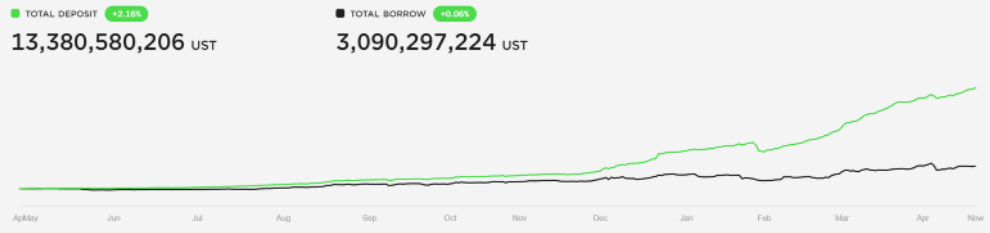

The current problems with Anchor and the decreasing yield reserves have only emerged since November 2021. Since November, due to a downtrend in crypto markets, a significant shift to a ‘risk off’ stablecoin farming strategy, and a decrease in leverage, the ratio between depositors and borrowers have continued to decrease. This is displayed below as the spread between deposits and borrowing has continued to increase with time.

Figures as of April 27, 2022

Sources: app.anchorprotocol.com ‘Dashboard’

The news of UST listing on Huobi and Binance, combined with the strong price performance of LUNA, has resulted in a large influx of investors into the Terra ecosystem and primarily into Anchor. This has further increased Anchor’s depositors and made it even more unsustainable in the short term.

Anchor simply needs more borrowers to close the gap between what the protocol generates and what it pays out. Borrowing is often a sign of improving market conditions, and it picks up dramatically whenever the major cryptocurrencies (Bitcoin, Ethereum, BNB, Solana) start an uptrend. While it is true that Anchor cannot continue to pay a 19.45% yield for anything longer than a couple of months, this dynamic can shift quickly. A bull market that results in greater returns for staking combined with increased demand for leverage could result in Anchor becoming cash flow generative once again.

The current Anchor model has successfully promoted the Terra ecosystem and UST. To a degree, Anchor acts as a marketing expense for Terra labs to generate publicity and demand for UST.

There is no better marketing strategy for a cryptocurrency project than creating the idea of a savings account that pays a 19.45% yield with very little volatility. There is an argument that Anchor’s short-term burning of cash to deliver a high yield and increase flows into Terra is akin to an early-stage tech company burning money on marketing, research, and development to create long-term value and cash flows.

Anchor cannot pay 19.45% in the long term, and it faces challenges in the future with questions surrounding the stop in borrowing incentives due to ANC reaching its max supply. However, Anchor could continue to pay a 4-5% low volatility yield over the long term and cement itself as the leading savings protocol within the DeFi space.

What are the primary risks associated with Anchor and how is Terralabs attempting to mitigate these risks?

The primary risk associated with Anchor and the Terra ecosystem is that UST de-pegs, i.e., the value of one UST deviates significantly from $1. UST is an algorithmic stablecoin that has its price maintained by a mechanism of burning and minting between LUNA and UST; it is not backed 1-1 by any hard asset such as US dollars. The foundation of UST is essentially trust. Users trust that they can exchange 1 UST for $1 worth of another asset. A de-peg event would be particularly disastrous for Anchor; all the individuals who sold their other crypto assets for UST to stake in Anchor could be completely wiped out, and $12.5 billion in deposits could vanish if no one trusts UST.

These risks are actively being addressed by TerraForm Labs and other products that are easy to access through the Anchor interface. Firstly, the Luna Foundation Guard (‘LFG’) and its founder, Do Kwon, have been prominent in cryptocurrency publications and Twitter due to their recent large purchases of Bitcoin and Avax to support the UST reserve, an initiative to ensure that UST keeps its peg. In early March 2022, LFG started a Bitcoin buying spree with the initial purchase of 1500 BTC (worth $59 million at the time) and has since accumulated around $1.7 billion worth of Bitcoin and $100 million worth of Avax. Do Kwon has announced the intention to back UST with $10 billion of Bitcoin and $200 million worth of Avax. In an event where the market price of UST deviated significantly from $1, the LFG will sell its Bitcoin and Avax holdings for UST in an attempt to restore the peg.

There is always smart contract risk associated with any DeFi protocol. Funds can be stolen by malicious entities who exploit problems in the project’s user interface or smart contract code.

In addition to the active work of the LFG to support the peg, Anchor depositors can utilise insurance from Unslashed Finance, where for a premium of 8.14%, the user can protect a subsequent deposit from smart contract risk and a de-peg event below $0.88; however, take note that insurance options are subject to their own conditions & risks.

The information in this post is provided for information purpose only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movement in rates or prices or any representation that any such future movements will not exceed those shown in any illustration. Users of this document should seek advice regarding the appropriateness of investing in any securities, financial instruments or investment strategies referred to on this document and should understand that statements regarding future prospects may not be realised. Opinion, Projections and estimates are subject to change without notice.

Greythorn Asset Management is not an investment adviser and is not purporting to provide you with investment, legal or tax advice. Greythorn Asset Management accepts no liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of this document, howsoever arising, and including any loss, damage or expense arising from, but not limited to, any defect, error, imperfection, fault, mistake or inaccuracy with this document, its contents or associated services, or due to any unavailability of the document or any thereof or due to any contents or associated services.