Market Summary

- Over the last fortnight, Bitcoin and Ethereum have increased by 12% & 25%, respectively.

- BTC 24k remained a significant level of liquidity, as echoed in our previous newsletter.

- Ethereum continues to be the main focus as we move closer to the Merge. This fortnight’s research piece will dive into what the Merge is & its implications for Ethereum moving forward.

- The Federal Reserve met expectations by increasing the US Fed Funds rate by 75 basis points at last week’s FOMC.

- US Q2 GDP growth came in negative last week Thursday. This was the second consecutive quarter of negative growth, unofficially signalling the beginning of a recession.

- Traditional markets have also increased over the past fortnight, with the S&P 500 & Nasdaq 100 up 6% & 7%, respectively.

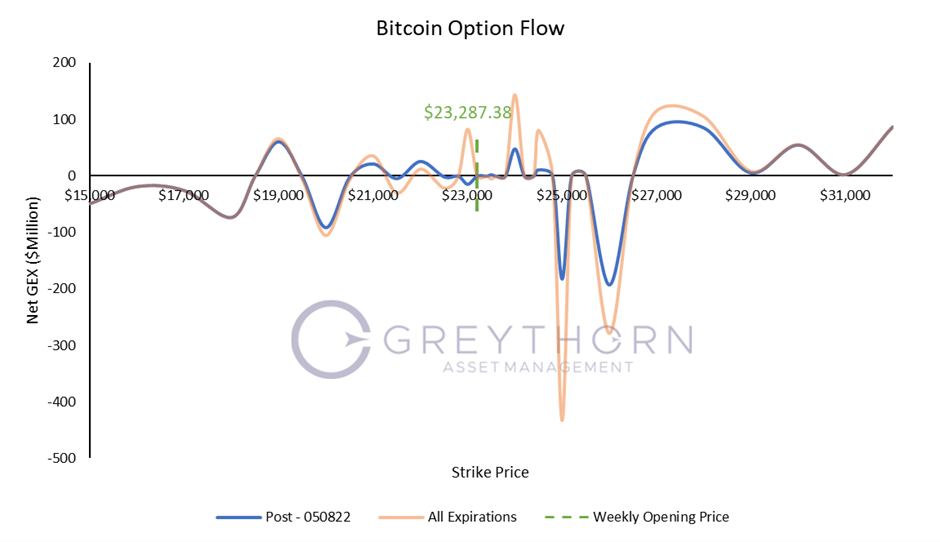

Greythorn Option Flow Model

Greythorn’s view of markets is significantly dependent on supply & demand mechanics. As crypto markets mature & attract large flows of capital, their derivatives markets also grow. Derivatives markets tend to have a large influence on their underlying assets as market participants tend to hedge their exposure through spot & futures markets. Our proprietary option flow model has been developed in-house to inform our judgement regarding how positioning across derivatives markets may influence the movement of Bitcoin.

Bitcoin opened the week at ~$23,000 after rising over the past fortnight following last week’s key economic data releases of interest rates & GDP growth.

Investors can anticipate increased volatility at a series of price levels with negative net GEX, namely $20,000, $25,000 and $26,000.

If price continues to increase, $24,000 can be seen as the first resistance level, followed by $24,500 and $28,000 as the second and the third resistances. On the downside, $23,000 may be viewed as the first support, while $22,000, $21,000 and $19,000 are weaker support levels. Notably, the magnitude of negative net GEX at $25,000 and $26,000 is significantly greater than any of the positive GEX levels. Compared to our data over recent weeks, the significance of liquidity-provision and liquidity-taking levels is considerably unbalanced. The strength of the former is far smaller than the latter.

A large number of monthly options expired last Friday (roughly 45% for Deribit and 40% for OKX), and the positive yet lower net option supply indicates an overall stable market for the upcoming week, if not flatter than the last week. However, considering that US unemployment figures are released this Friday, together with other traditional data points such as crude oil inventories, participants should remain flexible to both sides.

Based on our option flow model, Greythorn believes that Bitcoin will range between $19,000 and $28,000 over the upcoming week. For an introduction to Greythorn’s Option Flow Model, please refer to our newsletter from 8th June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter