Continuing our exploration into cash-flow generation across DeFi.

Last fortnight, we covered $dYdX, $GMX, & $GNS, dApps that allow for self-custody, decentralised trading & efficient uptime. There is a reason that these projects are trending, and it is because innovation across derivatives markets is at the forefront of user needs. Options trading has gained popularity in both traditional & web3 markets, and the crypto market has yet to find a leader/leading group of protocols to provide this service to the customer.

These projects have identified two different needs across the market, unique products with non-linear payoffs & the payout of protocol revenue to token holders.

The maturity of derivatives markets & the growth of the Real Yield trend signifies how far DeFi has progressed from its early days in 2018 to now, where market participants have gone from investing in ideas to products that provide actual cash flows.

The same trend is observed across traditional markets, where value & cash flows from utilities, health care & infrastructure are prioritised as opposed to speculative tech stocks.

For this fortnight, three projects named Dopex, Ribbon Finance & Synthetix have been on our radar because of the above traits.

1.Dopex – $DPX

Dopex is a decentralised options protocol whose value proposition minimises losses for option writers.

The critical mechanism lies in their rebate system, which compensates option writers based on their losses for weekly/monthly epochs. Writers receive a token, rDPX, relative to the value of their loss from the option pool.

Protocol Stats

Bullish Fundamentals:

- 30% of option losses are rebated to the user through $rDPX. $rDPX does maintain some form of utility through its use cases, i.e. trading synthetics of traditional asset classes through Umami Finance.

- Dopex utilises some of its oracles from Deribit, providing relatively competitive option pricing compared to other decentralised option protocols.

- A portion of protocol fees, 70%, is paid out to liquidity providers, 15% is paid out to $DPX stakers, and 5% is set aside to burn $rDPX, reducing its supply. These portions can be adjusted through $DPX governance votes.

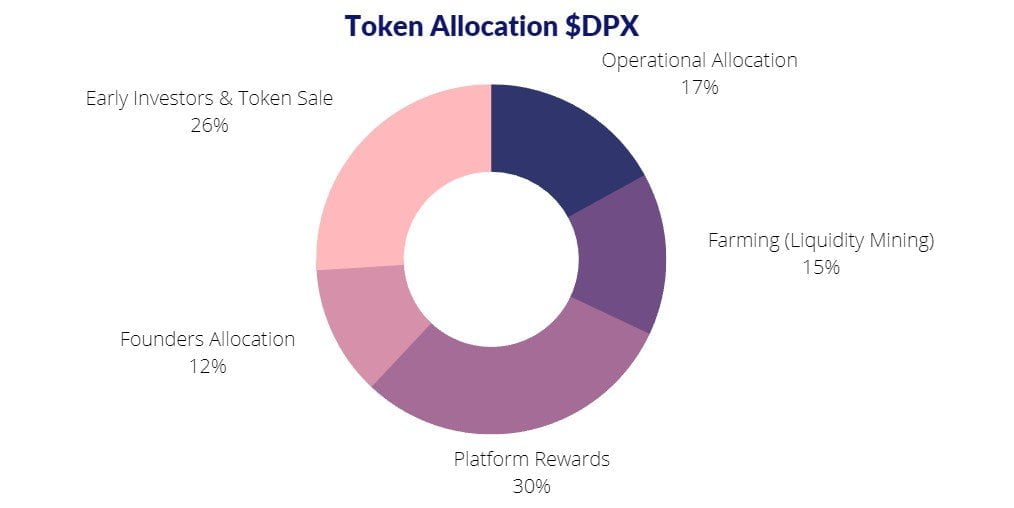

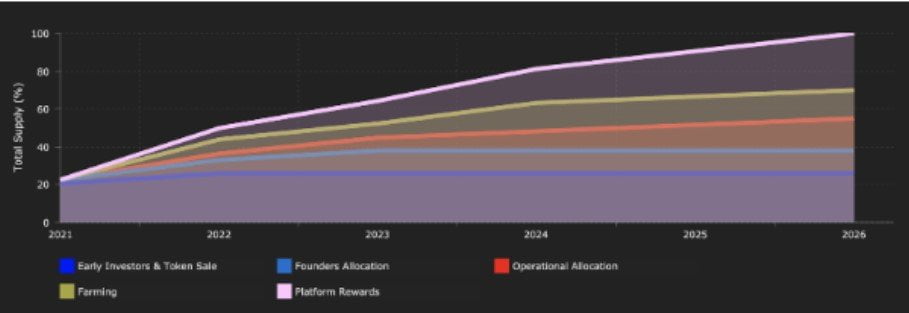

- Tokenomics design incentivises protocol improvement over the long-term & minimises significant price impacts from insiders (Founders & Early Investors).

The tokenomics are designed as follows:

- Operational Allocation: 17%

Distributed across five years. This allocation is used to initially handle governance, incentivise the development of community suggestions, help develop the platform with new features, and account for other operational costs.

- Farming (Liquidity Mining): 15%

The farming period is set to 2 years with an initial boosted rewards period of 4 weeks.

- Platform Rewards: 30%

Distributed over a period of approximately five years. These rewards will incentivise the use and upkeep of the Dopex platform.

- Founders Allocation: 12%

- 20% is initially staked in liquidity pools

- 80% vested for two years distributed using a drip system via a smart contract

- Early Investors & Token Sale: 26%

- Early Investors: 11%

- 50% Vested over six months

-

Token Sale: 15%

Bearish Fundamentals:

- Single Staking Option Vaults require the position to be fully backed in collateral of the base asset for calls, and USD stablecoins for puts, meaning that option writers do not have access to standard or portfolio margin.

- Leading crypto options exchange, Deribit offers slightly more competitive pricing (speed & accuracy) & deeper liquidity.

2. Ribbon Finance – $RBN

Ribbon Finance is a decentralised protocol that specialises in providing its users with exposure to DeFi structured products. Its Theta Vault is a yield-focused strategy on 9 separate crypto assets (including $USDC, $SOL, $ETH, $wBTC & $stETH).

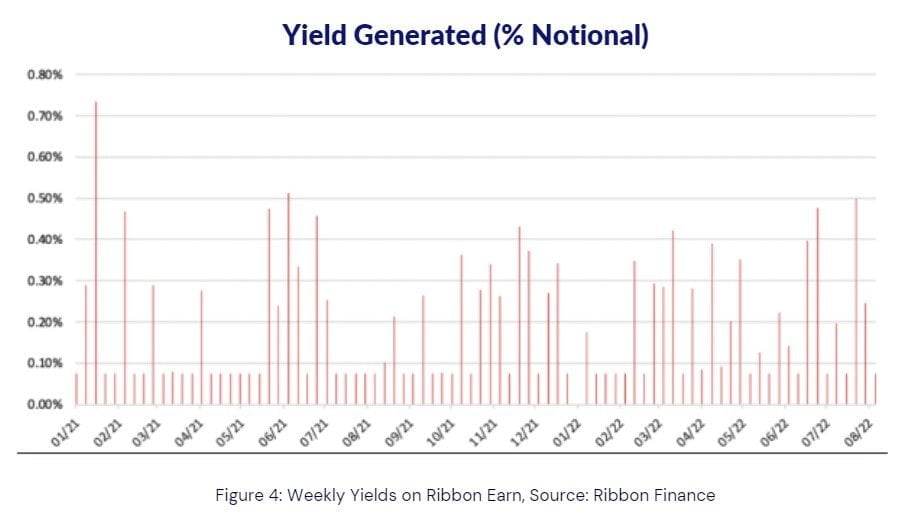

The protocol has garnered attention in recent weeks due to the launch of Ribbon Earn, a weekly automated options selling strategy that reinvests premiums into the product. The principal-protected product aims to earn a base APY through lending and use that APY to purchase weekly ATM knockout barrier options.

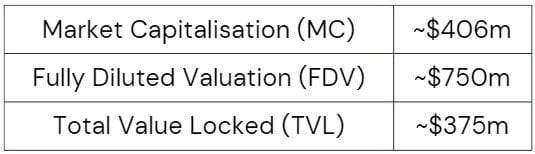

Protocol Stats

Bullish Fundamentals:

- Active users on the protocol are increasing, as expected by the growth of options trading amongst general retail & DeFi users.

- The market for structured products across DeFi remains even more untapped than standard derivatives. Ribbon Earn will appeal to the retail community due to its principal protection. A base APY of 4% is more competitive than the 3pool on the leading stablecoin dApp, Curve.

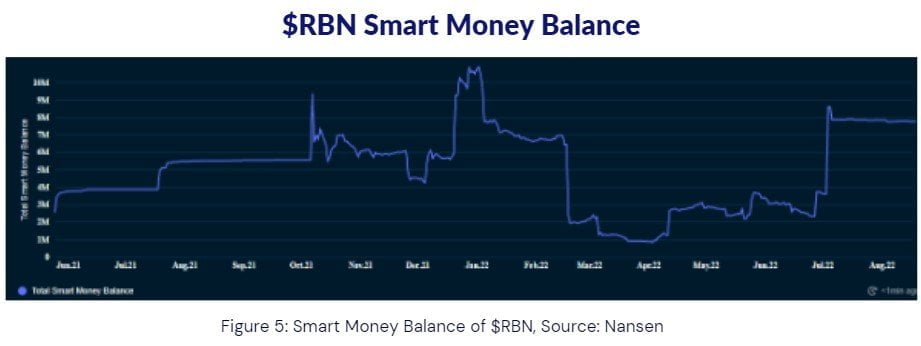

- Smart Money accumulated a significant amount of $RBN during July.

Bearish Fundamentals:

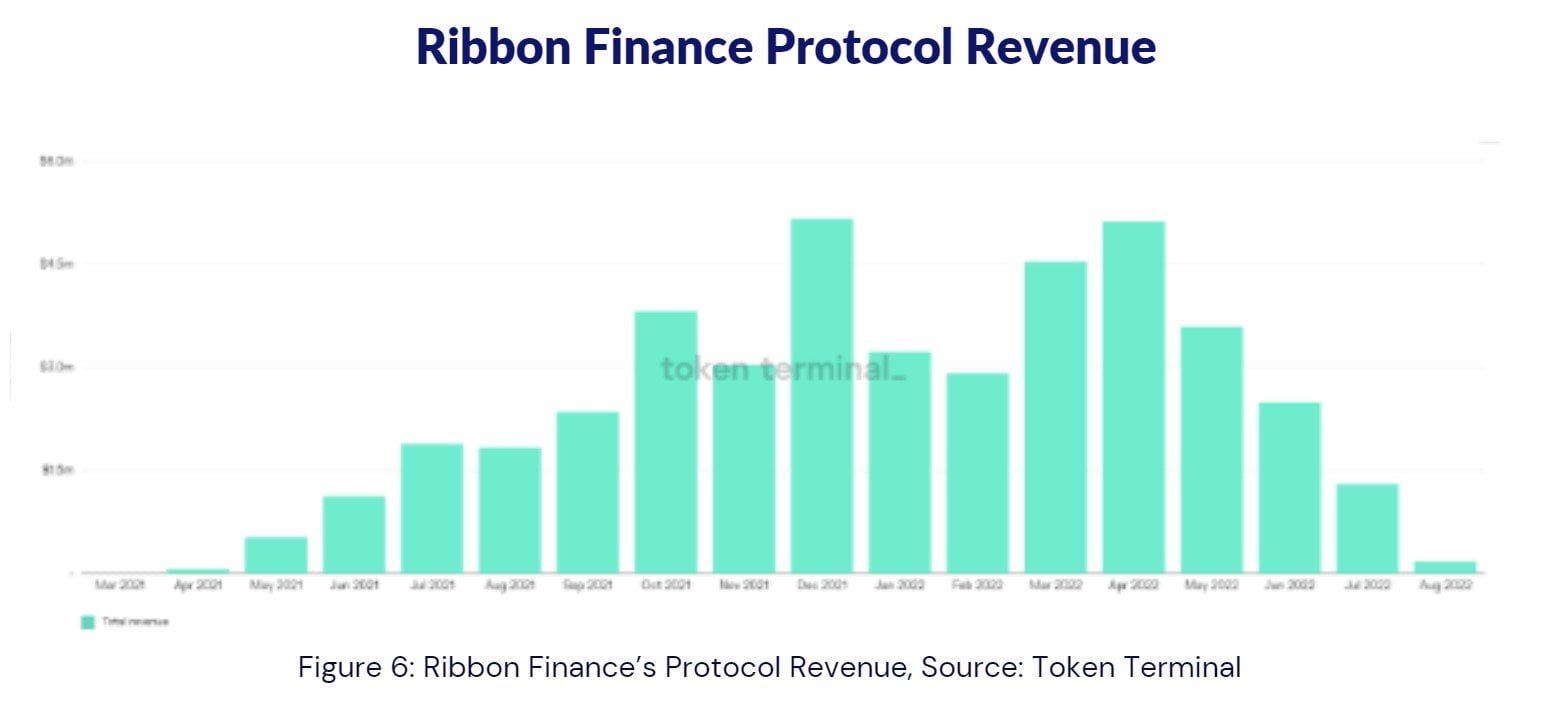

- The revenue earned across the protocol is decreasing. This is primarily due to the decline in TVL from ~$300m to ~$85m, attributable to the inflexibility of the strategies during market downturns. Covered Calls & Put Selling rely on relatively flat markets to optimise returns.

- P/E Ratio is relatively high at 213.8x.

- Other web3 options protocols, such as Dopex, offer attractive features such as 30% rebates on option writers’ losses.

- Ribbon Earn’s APY is capped at ~16%, meaning that participants will not be able to benefit from weekly moves beyond 8% for ETH.

- None of the products on Ribbon Finance allow its users to capitalise on significant moves to the upside, which may hinder user satisfaction during bull markets with high momentum.

- A relatively large amount of tokens are held within the community treasury, which may result in the centralisation of the DAO, coupled with the lack of transparency behind the usage of these tokens.

3. Synthetix – $SNX

Synthetix may not be the latest innovation across DeFi derivatives; however, it is the most successful project across its category and falls within the Real Yield narrative. We wanted to provide our readers with a breakdown of what has contributed to its success, together with the factors that can hinder the performance of the $SNX token.

Firstly, Synthetix is a dApp for synthetic assets. The protocol allows users to gain exposure to underlying assets through Synths without needing a user to own the underlying asset.

The platform offers a staking feature in which $SNX stakers are rewarded with a share of the transaction fees from the DEX. Fees to trade Synths are 30 bps.

Trading Synths requires users to lock up $SNX as collateral to mint $sUSD, which can thereafter be traded in exchange for Synths, essentially borrowing $sUSD with $SNX as collateral.

Since launch, the protocol has transitioned to the Optimistic Ethereum mainnet to aid with oracle latency from Chainlink & reduced gas fees.

Protocol Stats

Bullish Fundamentals:

- Its protocol revenue over the last 90 days dwarfs that of other DEXs that offer decentralised perpetual futures.

- Robust mechanism to provide demand for $SNX even though it is inflationary.

- The collateralisation ratio must remain greater than 400% to receive staking rewards. Rewards must be collected before weekly epochs end; if not, they are placed back into the staking pool, resulting in less supply than they would have been otherwise.

- The formula for the collateralisation ratio is staked $SNX/your share of the global debt pool. There are two scenarios in which your ratio can decrease, namely;

- $SNX decreases in value, or

- The global debt pool decreases, increasing your share of it.

- To deal with the first, users must purchase more $SNX & stake or redeem $sUSD.

- To deal with the second, you can reduce your debt by redeeming $sUSD or hedging your position through the platform’s partner, dHedge.

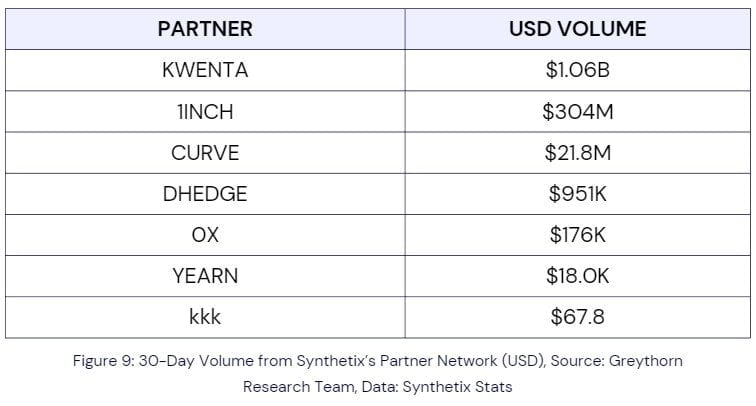

- Synthetix has a significant partner community that contributes to a portion of its trading volume.

- Competitive Funding Rates relative to a competitor like gTrade. E.g., The current funding rate for BTC perpetual futures on Kwenta is 5%, as opposed to 19% on gTrade.

Bearish Fundamentals:

-

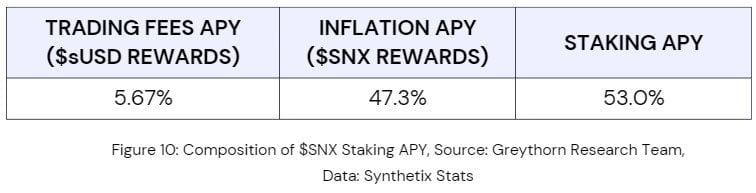

While the protocol does pay out a portion of the protocol’s revenue to stakers, the majority of $SNX’s staking APY is still from inflation.

*A recent proposal has been made by the founder to cap the supply of $SNX.

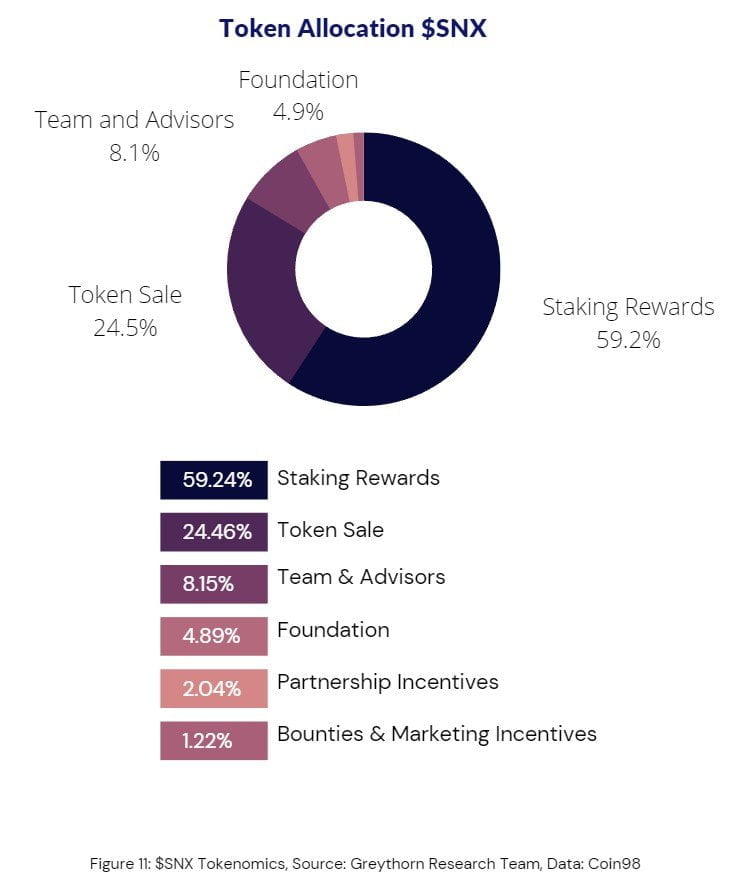

- Staking rewards comprise almost 60% of $SNX’s token distribution, with terminal inflation of 2.5% expected to begin in September 2023.

-

Many users stake $SNX & hedge their delta exposure through $SNX perpetual futures offered on exchanges, leaving them to collect staking rewards. The issue with this is that perpetual futures are associated with basis risk & funding rates. The current funding rates to short $SNX perpetual futures across the major exchanges range from 49%-58%, effectively neutralising the staking APY.

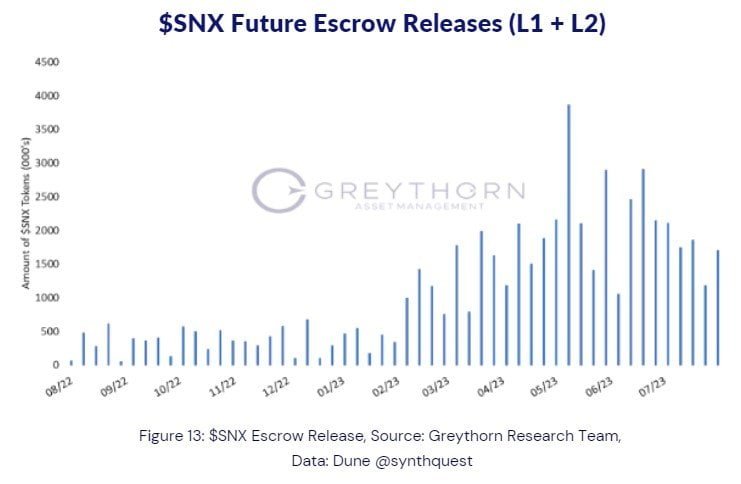

- $SNX staking rewards are escrowed & are only claimable after 12 months. While this could be considered helpful in assisting short-term supply pressure, the illiquidity of rewards is a concern. As illustrated by Fig.13, considerable escrow releases are due during mid-2023.

Closing Remarks

The distribution of protocol revenue to users is gaining popularity across DeFi. This article aimed to identify projects that employed this idea and expanded further into the potential headwinds that these projects may encounter with their method of executing this idea.

Nonetheless, innovation will continue across DeFi, notably derivatives, as the market continues to demand a variety of unique products to meet the demands of end-users.

References

- CoinGecko. 2022. Cryptocurrency Prices, Charts, and Crypto Market Cap | CoinGecko. [online] Available at: <https://www.coingecko.com/> [Accessed 26 August 2022].

- CoinMarketCap. 2022. Cryptocurrency Prices, Charts And Market Capitalizations | CoinMarketCap. [online] Available at: <https://coinmarketcap.com/> [Accessed 26 August 2022].

-

Coin98.net. 2022.

Coin98 Insights.

[online] Available at: <https://coin98.net/> [Accessed 26 August 2022].

-

Docs.dopex.io. 2022.

Protocol Overview

– Dopex. [online] Available at: <https://docs.dopex.io/> [Accessed 26 August 2022].

-

Dune.com. 2022.

Dune

. [online] Available at: <https://dune.com/synthquest/snx-escrow-release> [Accessed 26 August 2022].

-

Grafana.synthetix.io. 2022.

Grafana

. [online] Available at: <https://grafana.synthetix.io/d/pjPJZ6x7z/synthetix-system-stats?orgId=1&kiosk=full> [Accessed 26 August 2022].

-

Nansen.ai. 2022.

Nansen – Crypto,

DeFi & NFT Analytics. [online] Available at: <https://www.nansen.ai/> [Accessed 26 August 2022].

-

Tokenterminal.com. 2022.

Token Terminal

| Fundamentals for crypto. [online] Available at: <https://tokenterminal.com/terminal> [Accessed 26 August 2022].

Important notice and disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser.

This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based.

Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation.

This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.