StaFi is a cross-chain liquid staking protocol. It launched in 2020 & aims to solve the contradiction between mainnet security and token liquidity in PoS consensus.

Users maintain network security by staking, while Stafi Validators (SV) and Stafi Special Validators (SSV) are responsible for the safety of the whole protocol and all Staking Contracts, respectively. In return, stakers will receive rTokens (e.g. rDOT, rATOM, rBNB, rSOL, etc.) in a ratio of 1:1 of the staking tokens as the claim to staked tokens and staking rewards.

rTokens can also be traded in the secondary market or be utilised across other protocols to earn yield. At the same time, SVs are rewarded corresponding to the blocks they produced, and SSVs take profit from the multi-signature service and RPC service.

Transaction fees and liquidity fees are collected by the protocol’s treasury, along with any slash forfeits & staking rewards.

Token: $FIS

TVL: ~$30.21m

Market Cap: ~$41.74m

FDV: ~$84.53m

Use Cases

1. Fee Accrual:

- Gas (will be distributed to validators & Protocol Treasury).

- Service fee from users.

2. Value Capture: $FIS provides value for the liquidity of rTokens.

3. Supports Staking & Motivation Design:

- Block Election: A validator obtains its block weight by Staking $FIS or accepting the nomination of staked $FIS, under BABE (block selection) with the GRANDPA (finality) consensus mechanism. Nominators are also required to stake $FIS.

- Similar to Polkadot, StaFi improves the motivation curve per the Staking ratio of FIS for cyber security and long-term development.

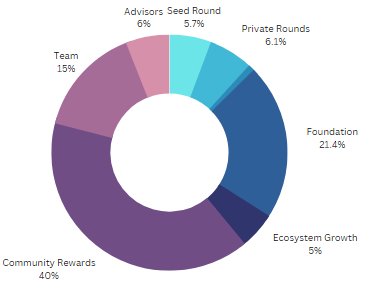

Tokenomics

- Initial Supply: 100,000,000 $FIS

- Token Distribution

- Circulating Supply: 60,452,000 $FIS (53%), Max Supply: 114,911,733 $FIS

- Apart from ecosystem growth & community rewards, all tokens have already been vested according to their schedule.

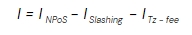

3. Inflation: To motivate SVs and SSVs, an inflationary supply is designed with an annual rate of between 5%-20%. StaFi Protocol will generate new $FIS (through a process called Coinstake) whenever a new block is produced. The formula is as follows

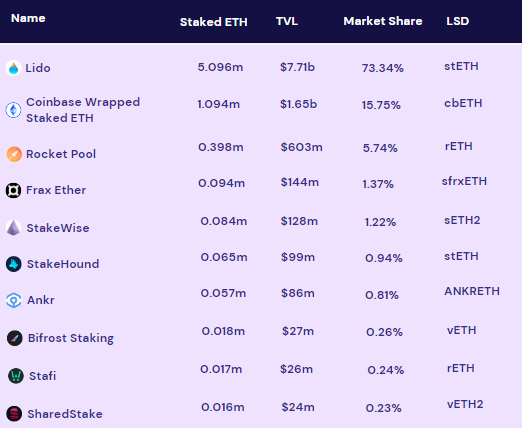

Comparables

Staked $FIS is ~37.27 million, which accounts for ~32.43% of issuance.

Bullish Fundamentals:

1. Security:

- Multi-signature Addresses & Secure MPC: Due to SSV’s random selection process of qualified SVs and the periodic replacement of SSVs, users’ staked tokens are sent to an intermediate address managed by multiple SSVs. This method allows for secure signing with private keys and transmission of calculations without the risk of information leakage.

- Regular rotation and emergency rotation of SSVs

2. Decentralised Validator Network: Unlike some of the projects following PoS, the chance to produce a block is equal to all validators, and each validator is entitled to equal voting power. That is, validators are equally likely to be elected, and there is no direct relevance between reward distribution and the weight of their stake.

Bearish Fundamentals:

- Inflationary: At present, the inflation rate is ~15%. Most tokens have undergone full vesting exclusive of inflation, with only 53% in circulation.

- 2. Concentrated Token Distribution: The proportion of tokens held by the team & investors is 33.07%.

Closing Remarks

With the rapid growth of liquid staking derivatives, StaFi’s design has earnt it a spot in the top 10. The protocol’s security & decentralised validator network are favourable proponents in the market for LSDs, however, its double-digit inflation rate & concentrated insider holdings have the potential to provide medium-term supply pressure.

References

- CoinGecko. 2023. Cryptocurrency Prices, Charts, and Crypto Market Cap | CoinGecko. [online] Available at: <https://www.coingecko.com/> [Accessed 10 January 2023].

- CoinMarketCap. 2023. Cryptocurrency Prices, Charts And Market Capitalizations | CoinMarketCap. [online] Available at: <https://coinmarketcap.com/> [Accessed12 February 2023].

- DefiLlama. 2023. DefiLlama. [online] Available at: <https://defillama.com/> [Accessed 12 February 2023].

- StaFi Docs. 2023. Welcome — StaFi_Protocol. Available at: https://docs.stafi.io/ (Accessed: February 14, 2023).

Important notice and disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser. This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.