Opening Remarks

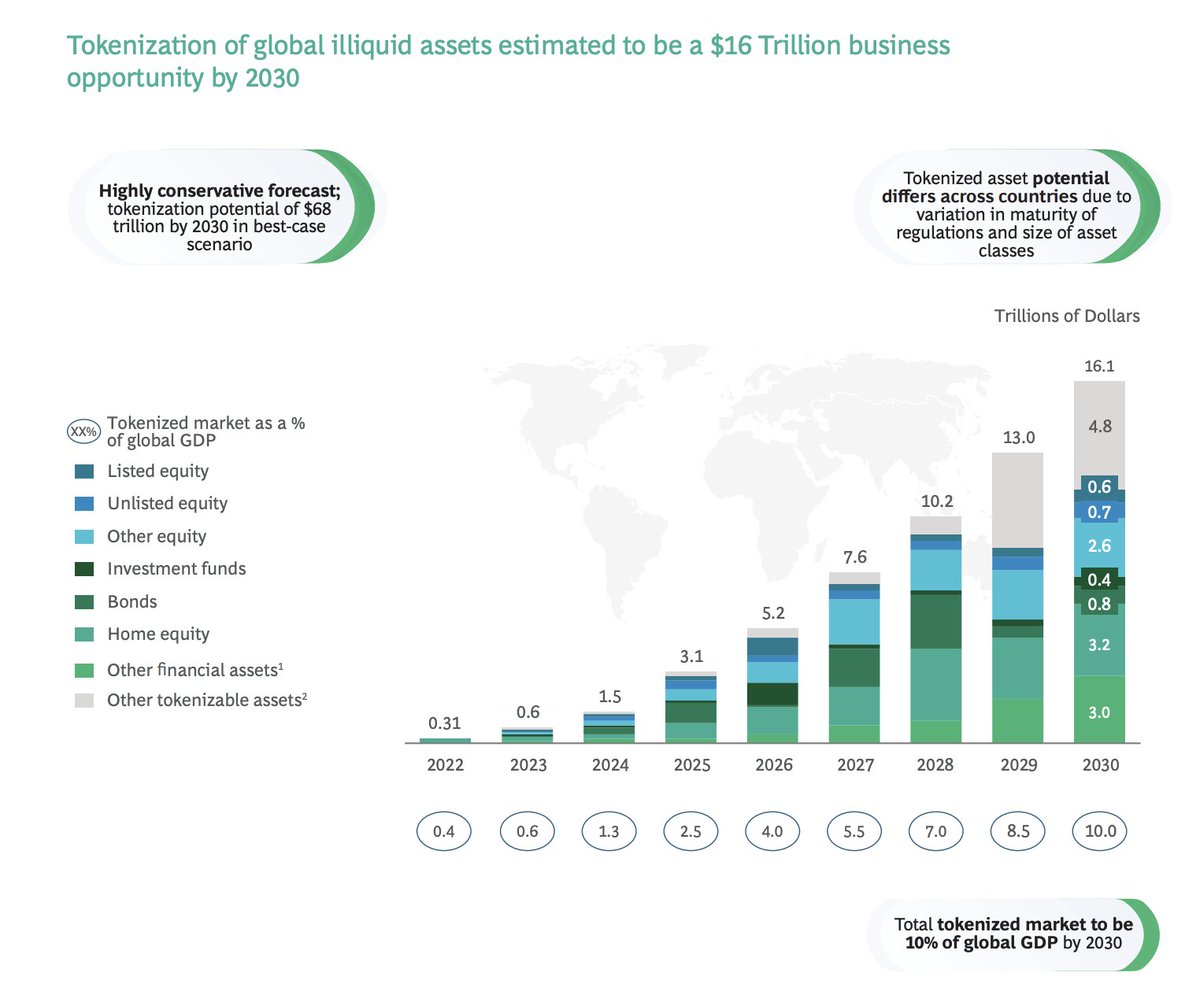

A few months ago, we released our first research on IX Swap, a project addressing liquidity challenges in the Security Token Offering (STO) market, also known as the Real World Asset (RWA) market. By creating a Uniswap-like exchange specifically for STOs, IX Swap bridges traditional finance and blockchain, enabling transparent and efficient trading of RWA like equities, bonds, and real estate. This approach has the potential to unlock a multi trillion dollar market, making these assets more accessible and tradable for both institutional and retail investors. In fact, research from Boston Consulting Group estimates that the market for tokenized illiquid assets could reach $16 trillion by 2030, accounting for 10% of global GDP. This shows the huge growth potential for platforms like IX Swap.

Source: Boston Consulting Group

Our initial piece covered IX Swap’s market potential, main offerings like the Secondary Trading Product and launchpad, as well as team, tokenomics, and fundraising insights. We also highlighted both bullish and bearish factors for the project.

Today, we’ll revisit the tokenization space, discuss new developments at IX Swap, and offer our thoughts on the future of this market.

Global Tokenization Developments

Previously, we highlighted the rising interest in tokenization, with BlackRock’s CEO Larry Fink calling it the future of finance. We also noted how JP Morgan, Fidelity, the DTCC, and Deutsche Bank were already testing tokenization through pilots and initiatives, and the World Federation of Exchanges viewed it as a natural step forward.

Since then, tokenization has continued to gain traction. SWIFT is expanding into tokenized securities settlement to link traditional and digital asset networks, while Project Agorá, led by the Bank for International Settlements (BIS), is exploring cross-border tokenized cash transfers with participation from central banks and major institutions like Banco Santander, MasterCard, and JP Morgan.

Euroclear has issued digital bonds in compliance with traditional regulations, and a Citi survey shows growing institutional interest despite regulatory hurdles, particularly in the U.S.

Source: Citi’s Securities Services Evolution 2024

Meanwhile, Germany’s KfW issued a €4 billion digital bond, and platforms like Boerse Stuttgart and Clearstream are experimenting with tokenized securities, with participation from the country’s largest banks. Even governments are getting involved—Slovenia recently issued its first digital bond.

On the private investment side, platforms like Coinbase and Hamilton Lane are making tokenization more accessible, while Bitfinex Securities and Franklin Templeton are launching tokenized bonds and funds, respectively, across multiple blockchains.

These developments show the rapid growth of tokenization across finance, setting the stage for platforms like IX Swap to bridge traditional finance and digital assets by providing liquidity and transparency in private markets.

IX Swap Strategic Positioning in Tokenized Finance

IX Swap’s co-founder, Julian Kwan, recently spoke at the 2024 STO Summit in Korea, where he outlined the platform’s vision to reshape the security token market. As the first fully licensed exchange solution for security tokens, IX Swap, along with its sister company InvestaX, aims to tap into the massive private market, which includes real estate, private equity, startup stocks and other areas traditionally dominated by paper-based transactions and restricted to institutional investors.

Unlike fully decentralized exchanges like Uniswap, IX Swap blends decentralized features such as liquidity pools and automated market makers (AMMs) within a regulated framework, allowing it to offer liquidity for security tokens while staying compliant with licensing requirements. This hybrid model addresses one of the biggest challenges in the security token space: balancing liquidity with regulatory oversight.

He explained that the platform’s goal is to democratize access to a wider range of assets by tokenizing not just traditional securities, but also less common assets like ownership stakes and advertising rights, making it easier for retail investors to participate in markets previously limited to high-net-worth individuals. This could significantly expand investment opportunities beyond what conventional exchanges like NASDAQ can offer.

One standout feature of IX Swap is its ability to let anyone create their own liquidity pool with tokenized assets, even with very little capital. For example, a startup owner can pair their tokenized shares with USDT and establish liquidity, offering a new way to raise funds and trade shares, something not possible in traditional finance.

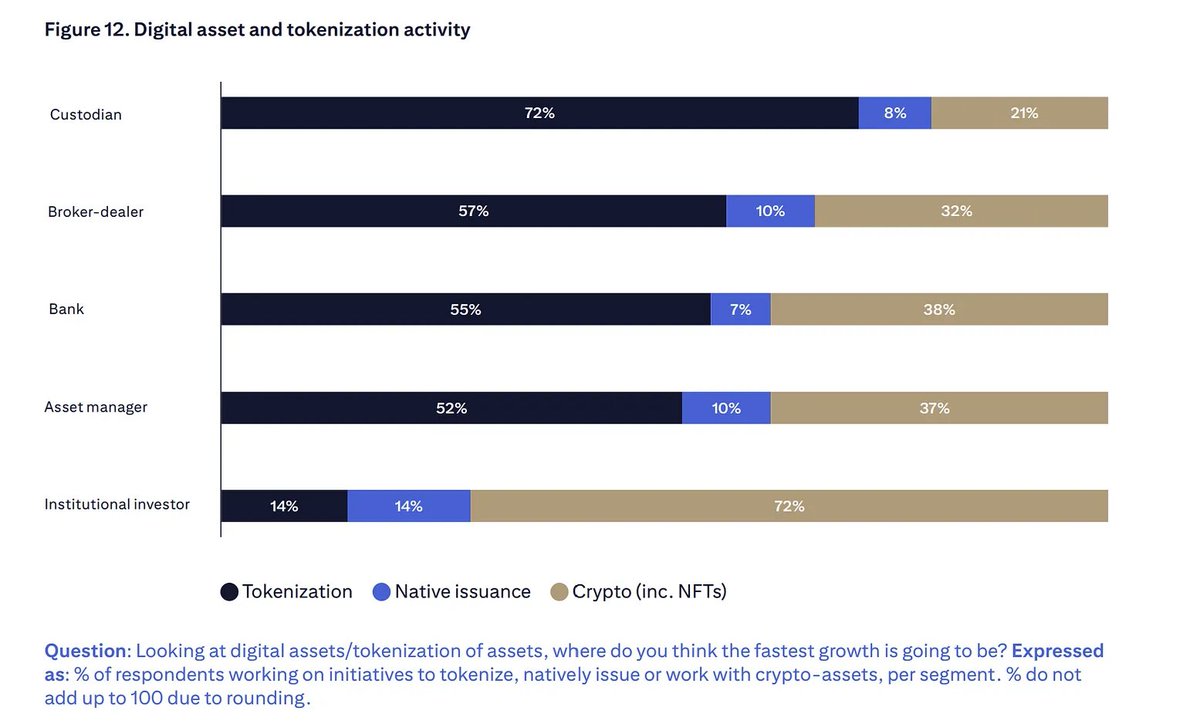

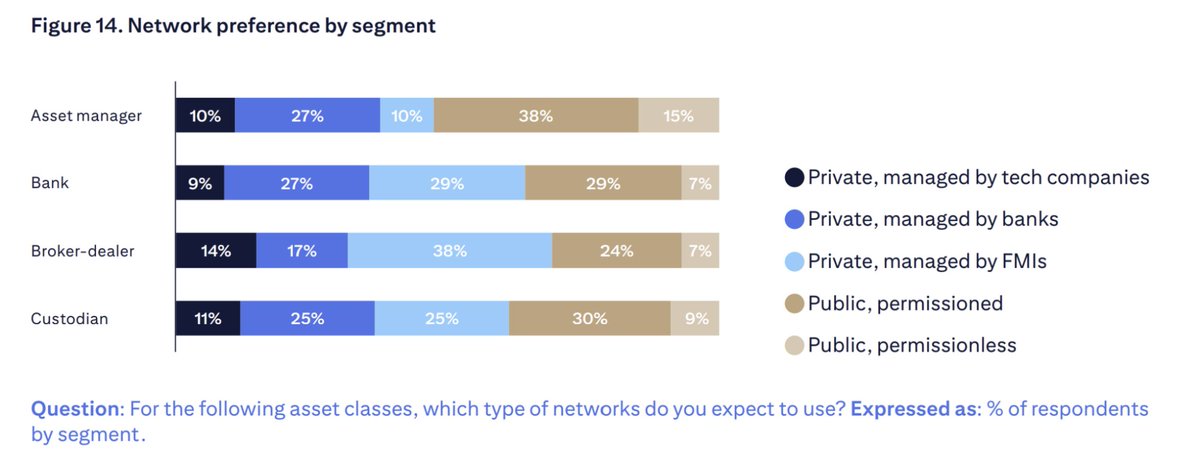

Kwan also highlighted the ongoing debate between private and public blockchains for security token issuance. According to a recent Citi survey, 64% of sell-side firms working on DLT projects favour private blockchains for better control and security, while over half of asset managers lean toward public blockchains to prioritize liquidity and broader access.

Source: Citi’s Securities Services Evolution 2024

Despite the initial preference for private chains for some institutions, Julian believes public blockchains are the future. He argues that the real value of digital assets comes from their ability to interact within a larger ecosystem, which only public chains can provide. Private chains, in contrast, limit connectivity and restrict access to the broader potential of digital assets.

IX Swap stands out by connecting tokenized assets with DeFi solutions like automated market makers, going beyond simple digitization to enable a new era of programmable securities. Julian compares this to the impact ETFs had on public markets back in 1989.

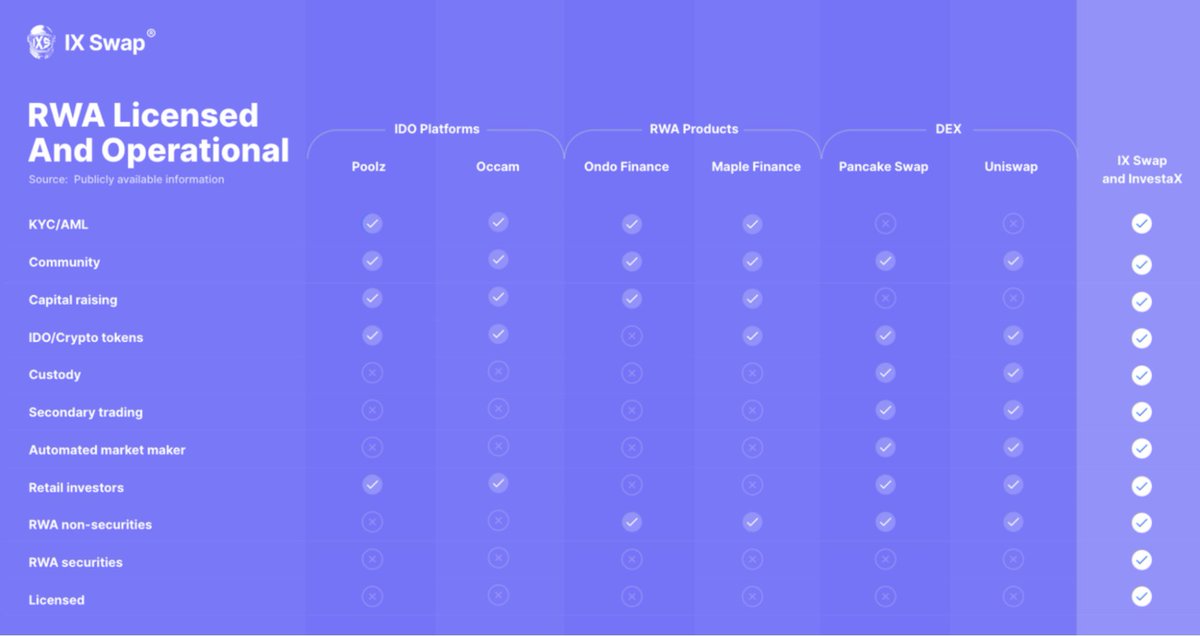

What sets IX Swap apart is its accessibility. While competitors like Ondo and Maple Finance mainly target institutional investors, IX Swap opens up security token investments to a wider audience, including retail investors. This broader reach, combined with the ability to help DeFi platforms legally offer security tokens, positions IX Swap as a major player in the evolving tokenized finance market.

Source: IX Swap

IX Swap also stands out as the only platform enabling retail participation in tokenized real-world assets through a quick 3-step, 5-minute KYC process:

- Personal Information: Name and email.

- Secondary Info: Proof of address or business email.

- Document Verification: ID verification, and you’re done.

This streamlined approach ensures full compliance while making it easy for anyone to invest and participate in STOs. During the same event, co-founder Aaron Ong highlighted IX Swap’s appeal, noting that private markets have historically outperformed public markets, likely due to factors such as the illiquidity premium, active management, market inefficiencies, and longer investment horizons that enable a focus on long-term strategies. However, McKinsey’s 2024 report shows that the gap is narrowing due to rising costs and lower valuations. Despite this, private market assets under management grew by 12% to $13.1 trillion, and 88% of investors, according to a recent survey by Adams Street Partners, still believe private markets will continue to outperform public ones.

IX Swap: Recent Partnerships and Developments

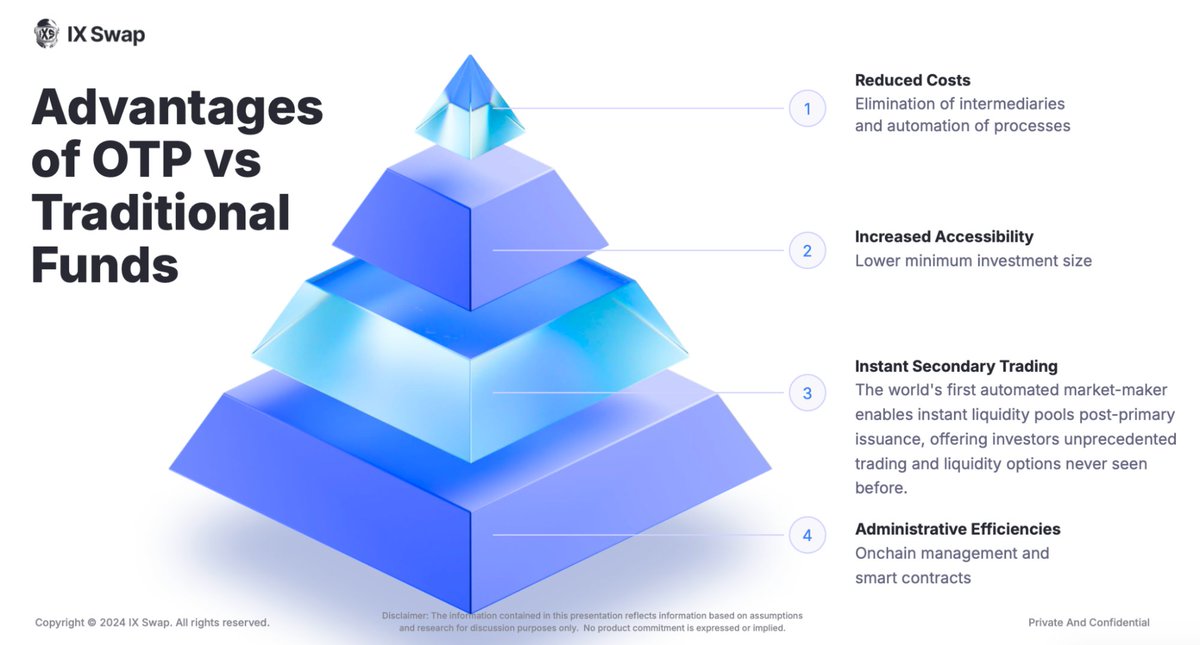

IX Swap has recently made a lot of progress with new partnerships, updates to its staking model, and growing its network to support RWA tokenization. One of IX Swap’s latest innovations is its Onchain Tokenized Portfolios (OTPs). The first to launch is Coach K’s GameFi Portfolio (CKGP), which lets investors buy into a diverse set of GameFi projects directly on the blockchain. This opens up opportunities for everyone, not just big investors. With 380 participants and 500,000 USDT raised, it’s clear that there’s a strong demand for this kind of investment product.

Tokenized portfolios like CKGP allow investors to hold fractional shares in diversified assets, making it easier for smaller investors to enter the market. This isn’t just about adding another product, but rather about anticipating what the adoption of tokenization could look like in the future. As more people see value in these accessible and secure investment options, it supports the broader trend of bringing traditional finance products into the DeFi space.

Source: IXSwap

For IX Swap, this type of product reinforces its position as a leader in tokenized RWA solutions. Successfully executing a new type of investment vehicle proves the platform’s capability and vision to innovate, while its fully legal and compliant structure boosts confidence among both retail and institutional investors.

Key Partnerships

- RWA NOVA: Partnered to bring real estate to the blockchain, making it possible to own fractions of properties around the world.

- Base Chain Integration: Joined Coinbase’s Base network for faster transactions and lower fees. Staking and bridging are now live, allowing users to stake $IXS and earn RWA airdrops, bringing more value to token holders.

- South Korea Expansion: Strengthened its presence by attending the STO Summit and Korea Blockchain Week.

- NEOPIN: Partnered to launch a new token swap pool, improving compliance and security.

- XMAQUINA: Tokenizing autonomous robots, opening up new and unique investment options.

- Patex: Partnered with Latin America’s biggest RWA platform to support financial inclusion.

- VESTN: Tokenizing high-end commercial real estate, giving more people a chance to invest in luxury properties.

- SolidProof: Teamed up with a blockchain auditing firm to improve security and transparency.

- ArkeFi: Providing liquidity to tokenized luxury items like rare art and high-end cars, allowing both small and large investors to buy pieces of these valuable assets.

A Smarter Staking Model

Instead of the usual staking programs that cause sell pressure, IX Swap’s new model rewards users with RWA equity tokens rather than more $IXS. It’s similar to an ESOP (Employee Stock Ownership Plan) but built for the community. This model not only aims to help keep $IXS prices stable but also a more committed user base.

Recent Milestones

- $SSOL1 Airdrop: Successfully completed the airdrop of $SSOL1 tokens, showing IX Swap’s capability to deliver on its promises.

- $CKGP OTP Performance: The $CKGP OTP has delivered over 10% returns in just a few months, suggesting potential annualised returns of 100-150% (subject to market price fluctuations).

Source: IX Swap

What’s Next?

IX Swap is working on integrating with major crypto wallets and is in talks to potentially get listed on big exchanges like Coinbase, Binance, and top Korean platforms. It’s not easy, but the focus is on building real value and use cases for RWA in the crypto world.

Final Thoughts

Tokenization continues to capture the interest of institutions worldwide, and it’s easy to see why. It’s not just about making financial assets easier to access; it’s about creating entirely new opportunities and markets. Despite facing hurdles like fragmented markets and regulatory challenges, the momentum behind tokenization is undeniable. Projects like IX Swap are building the groundwork for a more accessible and liquid financial system in a transparent and regulated way.

Our research shows that progress is happening faster than many expect. Each new development is taking us closer to a future where trading RWAs is as straightforward as trading crypto. As Bill Gates once said, “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten.” With the rapid evolution in this space, it’s only a matter of time before tokenization’s full potential becomes a reality, unlocking a new era for global markets.

At Greythorn, we’re more than just an investment fund. We’re dedicated to delivering valuable insights and research to the community. We’ll continue to share our perspectives on emerging projects and trends, but it’s important to remember that this is not financial advice and many of the projects we analyze don’t currently form part of our portfolio, but we believe in keeping a pulse on the market to identify future opportunities.

Disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser. This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.