It’s hard to argue against the fact that the market has gone through a sequence of storms. From a hopeful 2021 in Bitcoin prices to a 50% drop in the first semester of 2022, followed by what seemed to be a non-stop train of corporate drama. Taking a further step into the train metaphor, crypto appears to be the type of train that everyone is eagerly hopping in as passengers and praying that it will somehow drive profit. However, looking retrospectively into 2022, this is probably the time to question the destination and the drivers.

Mainstream big crypto players, such as Binance, and FTX, along with other large institutions, have long been looked upon by the crowd, even if some will never admit it. In a market that praises itself for the benefits of decentralisation, crypto users were slowly adopting a herd behaviour around big money holders, or as Nansen calls it, Smart Money. As Freud would have argued, it is just inherent human behaviour to gather around people with internal and/or external attributes we would like to have ourselves, whether it’s an emotion or the capabilities to generate monetary returns. Beyond the psychoanalysis, the question of the moment is whether the crisis will instigate the urge to find new leadership figures to follow or lead to the realisation that in this new bullet train, we are all drivers, not passengers.

For any crypto user with access to Twitter, the hashtag “not your keys, not your crypto” and decentralised organisations “shilling” their products must have flooded the home timeline. It is understandable to use recent tragedies to vilify centralised organisations, especially if you have unfortunately lost a sum of money. It is also easy to claim that users were careless in over-relying on third parties to keep their digital assets. However, the truth is that we have been conditioned since birth to rely on formal institutions to safeguard our money, be it the bank or our parents. Thus, “self-custody to gain financial sovereignty”, as beautiful as it may sound, the journey to rewire the financial system will be as challenging and crucial as stepping into adulthood.

So where is it heading to post-2022?

We could be living at a turning point in defining the direction crypto will take not only for the year 2023 but also in a longer timeframe. In an article from 2018, the Guardian claimed that “blockchain isn’t about democracy and decentralisation – it’s about greed”. Nonetheless, there may be a turning point if we can take advantage of the tumultuous happenings to rediscover the fundamentals that brought us together into crypto. For the industry to mature beyond the mentality of monetary gains at any cost, there must be a narrative to build value.

If we dive deep into decentralisation, financial democracy must be present; otherwise, it would be a mere shift in power. Dēmos literally means people in Greek, and kratos means “rule” – rule by the people. In modern society, with all its layers of complexity, to be truly ruled by the people, there must be participation and a certain degree of consensus to carry the talk forward from diverse crypto players and social groups, including political organisations, traditional financial institutions, corporate brands, and general retail investors.

DeFi must be praised for contributing to taking the initial steps into financial democracy. If you join a DeFi project’s Discord with 1K+ users, it’s not hard to find people from diverse backgrounds in the community. Crypto is about democratising finance so that your neighbour who has a small local gardening business can now hedge together with Elon Musk. It is the possibility of creating new ways to gain exposure to what used to be exclusive financial tools to Wall Street without being a part of the circle. Previous narratives mentioned by the Greythorn team, such as Real Yield, were some of the factors that contributed to popularise DeFi.

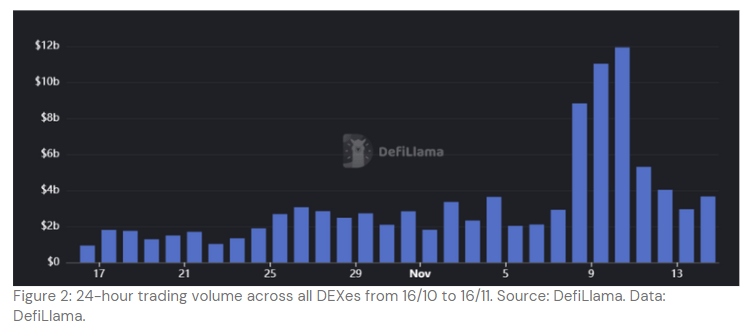

As figure 2 shows, there was a spike in the volume traded across DEXes in the days preceding and succeeding the FTX fallout news.

With JP Morgan and Nike partaking in web3, these could be taken as signs of a possible narrative involving traditional market companies incorporating crypto into their core services to bring it closer to the reality of a wider audience. It should not go unnoticed Instagram’s initiative to allow creators to mint and sell NFTs on the platform or Telegram using a marketplace built on TON to auction usernames. Even though it is hard to predict the next big narrative or the next destination of crypto, as the market has already proven its unpredictability numerous times, it will certainly be worthwhile to see how it will react to the different dynamics brought by new players.

References

- CoinGecko. 2022. Cryptocurrency Prices, Charts, and Crypto Market Cap | CoinGecko. [online] Available at: <https://www.coingecko.com/> [Accessed 29 October 2022].

- CoinMarketCap. 2022. Cryptocurrency Prices, Charts And Market Capitalizations | CoinMarketCap. [online] Available at: <https://coinmarketcap.com/> [Accessed 29 October 2022].

- DefiLlama. 2022. DefiLlama. [online] Available at: <https://defillama.com/> [Accessed 29 October 2022].

- DefiLlama. 2022. DefiLlama. [online] Available at: <https://defillama.com/dexs> [Accessed 22 November 2022].

Important notice and disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser. This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.